In finance, fraud is inevitable. It’s the most common crime in the UK, making up nearly half of all criminal activities in the region.

Despite its prevalence, there appears to be no definitive solution to fraud, as bad actors continuously evolve their tactics and find new ways to exploit the system.

In Nigeria, banks lost $25.7 million to fraud in Q2 2024, marking a staggering increase from the previous quarter.

Several startups are tackling fraud in Nigeria’s financial sector by developing digital identity verification and detection tools to curb fraudulent activities. The thinking is that by properly identifying customers, the incidence of fraud can be reduced through documentation of perpetrators and information sharing.

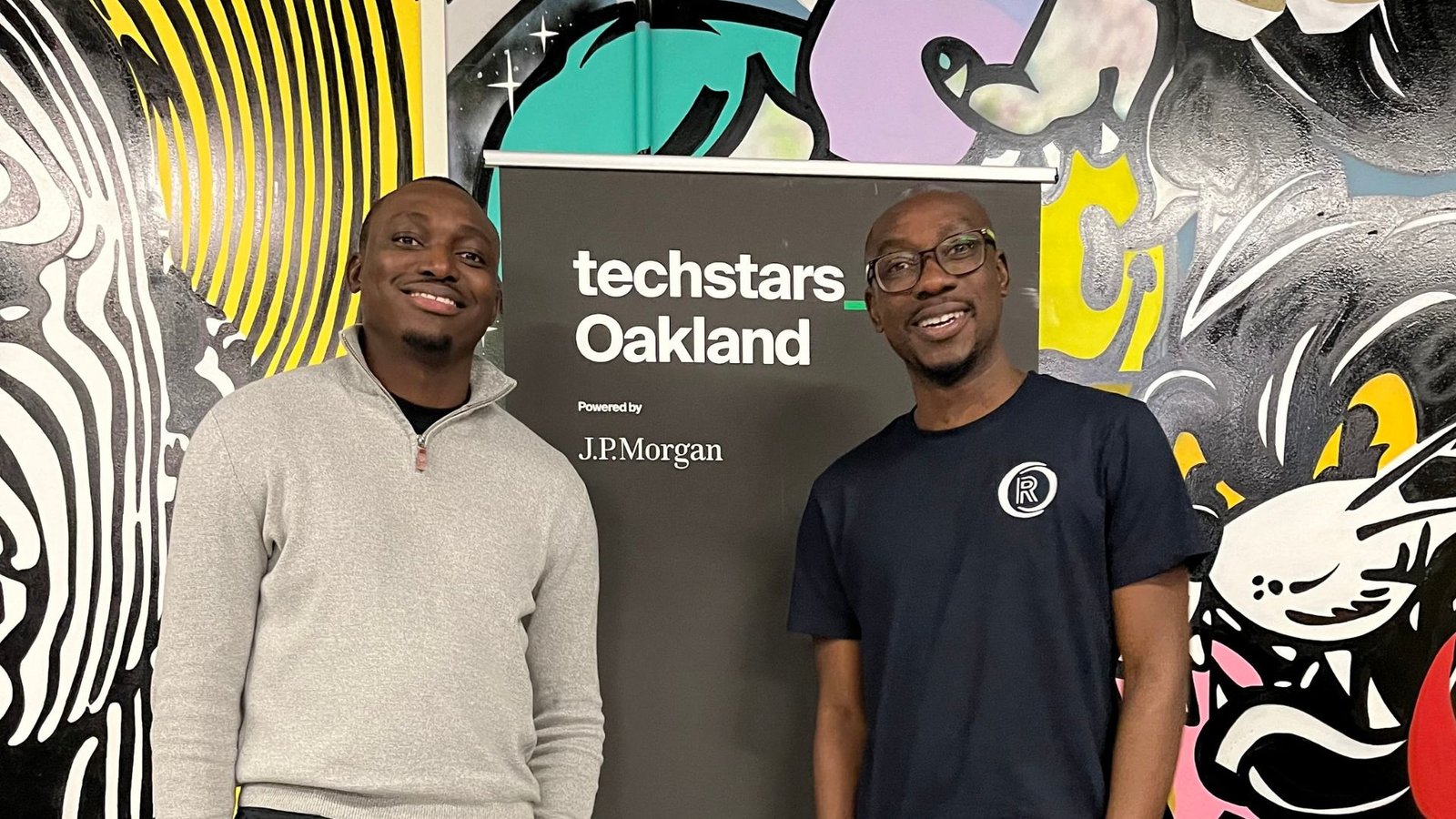

One of the newer entrants, a startup, has raised $1.1 million in pre-seed funding to help businesses streamline customer onboarding, monitor transactions, and prevent fraud. It already serves 20 businesses, including Cowrywise, VFD Bank, and Piggyvest.

In an ecosystem where fraud is a growing concern and fraud prevention is a saturated market, this startup offers a unified platform that integrates Know Your Customer (KYC) compliance, transaction monitoring, and regulatory reporting—features that competitors offer separately.

The startup uses a subscription model, charging annually for full access and also charging per-use fees for individual screenings.

Despite the rise of this platform and similar platforms, fraud continues to thrive. One reason may be that technology, while essential, isn’t a silver bullet. Gaps in enforcement, the sophistication of fraudsters, and inconsistent adoption of tools by businesses leave room for bad actors.

The goal is to close these gaps by being a one-stop shop for compliance, but the challenge remains whether this tech-led approach can truly curb the rising tide of fraud in Nigeria.

Leave a Reply