Cross-border payments are evolving in Africa. Various startups are emerging daily, offering new methods for sending and receiving money across borders, utilizing stablecoins, virtual wallets, or API integrations.

With the increasing digital commerce activities on the continent, simplifying cross-border payments has become crucial for financial players to tackle.

Despite advancements from the days of Hawala and slow wires, challenges like high costs, limited coverage, and fiat currency conversion complexities persist.

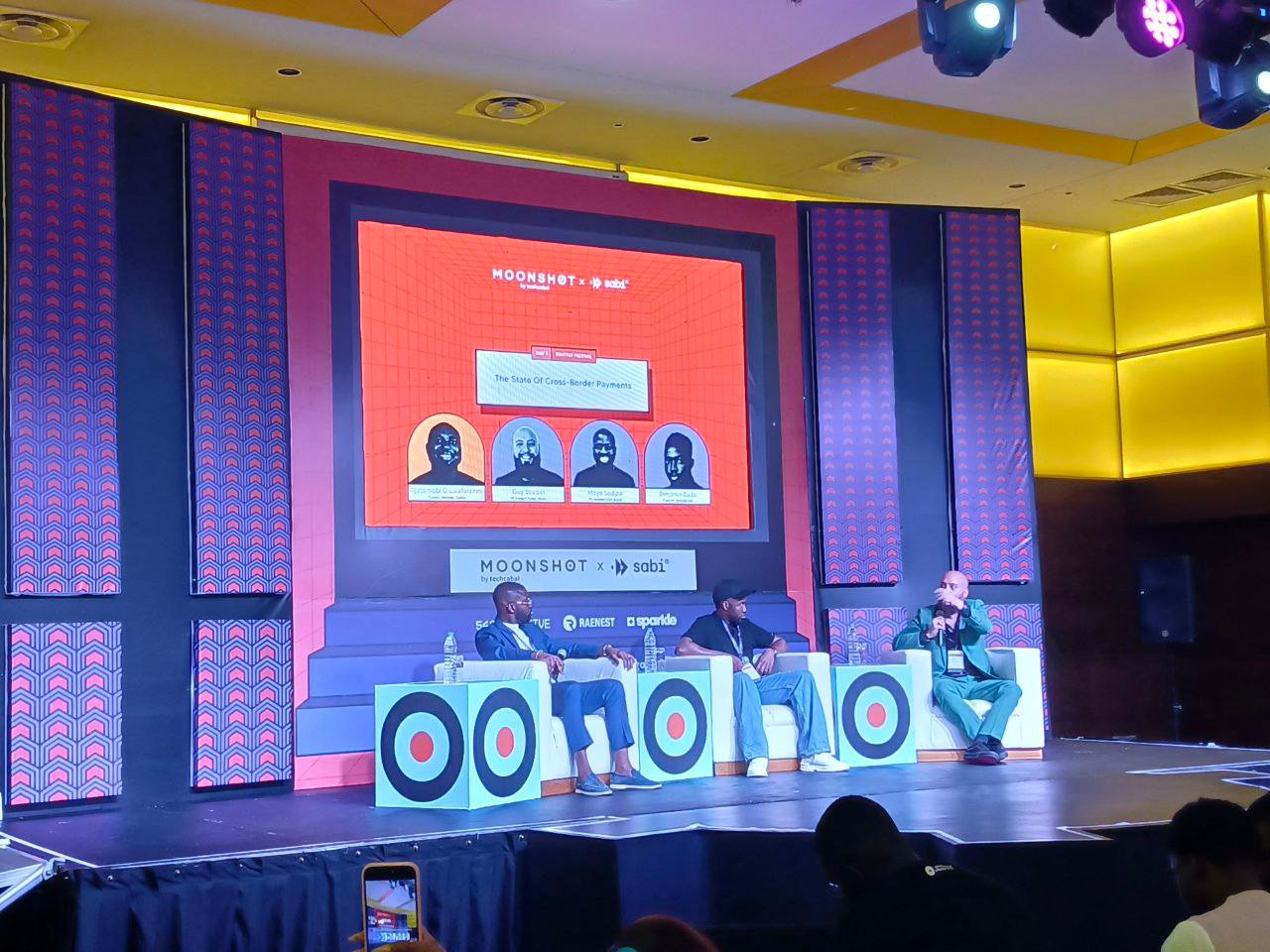

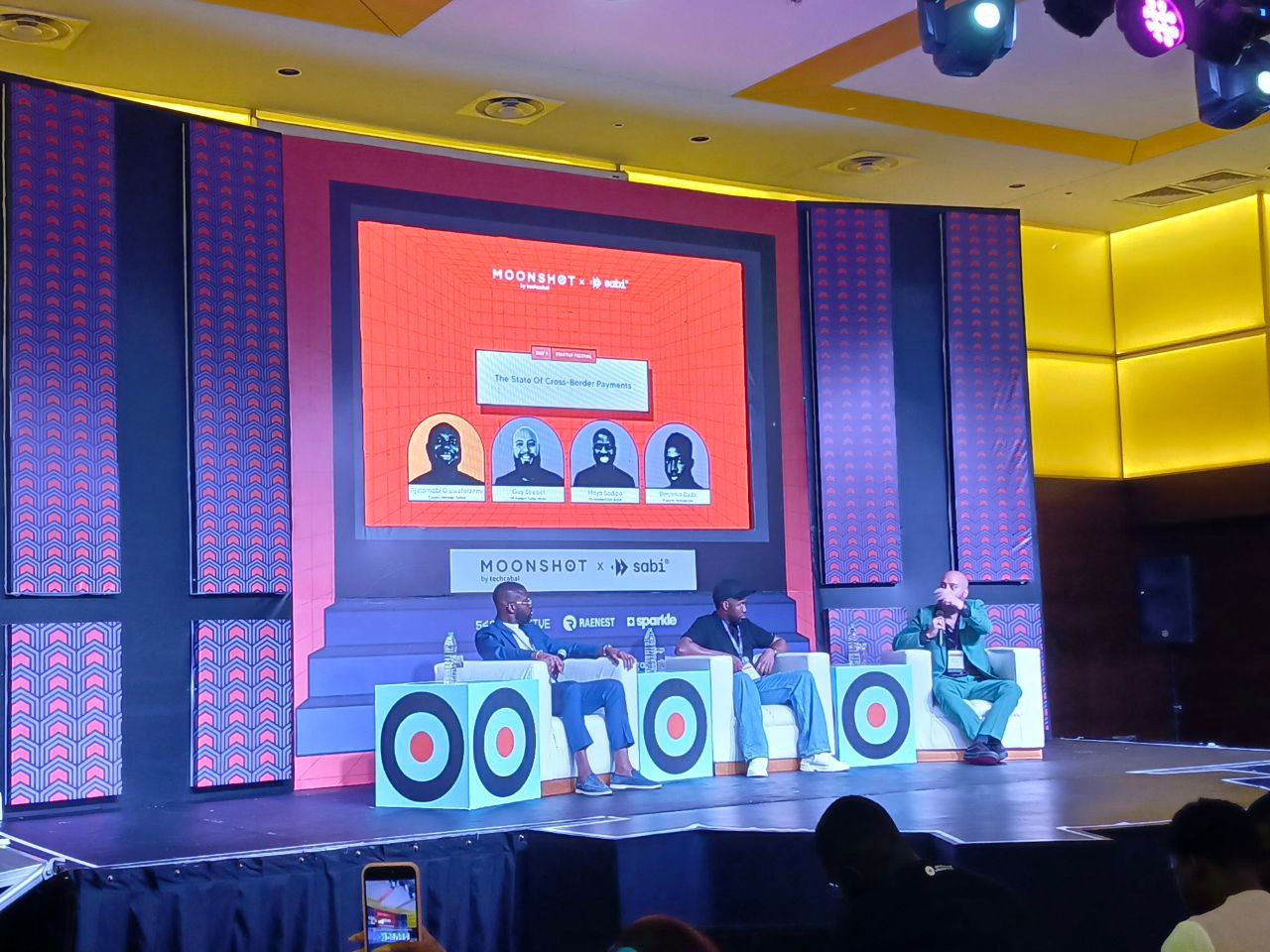

Experts in the payments industry emphasized the need for improved technology to facilitate faster data exchange during cross-border transactions over regulatory obstacles in Africa.

Fintech companies see an opportunity in addressing the historical inefficiencies of cross-border payments, leveraging technology to make a positive impact, according to Guy Stiebel, VP Product of Cedar Money.

While traditional banking institutions may be slower to adopt trends in cross-border payments, a hybrid approach combining fintech agility with traditional banks’ reliability and regulatory expertise holds promise.

Collaborations between fintechs, traditional banks, and regulators could lead to innovative solutions that align with government interests and reduce regulatory challenges.

Despite regulatory dynamics, experts are optimistic about the potential for further innovations in cross-border payment solutions.