Startups originating from Africa have the potential to create solutions that can be expanded globally, according to investors who participated in a recent event. These startups require support in the form of funding, access to networks, and market insights to realize their international aspirations.

In the African business landscape, the common approach to expansion often involves launching in one of the major markets and then growing from there. Recently, African startups like TymeBank, Flutterwave, and Moove have ventured into markets such as Southeast Asia and North America.

Expanding into foreign markets necessitates startups to possess a clear understanding of what it takes to thrive in different countries. This understanding is usually derived from having investors who are willing to support the founders’ visions.

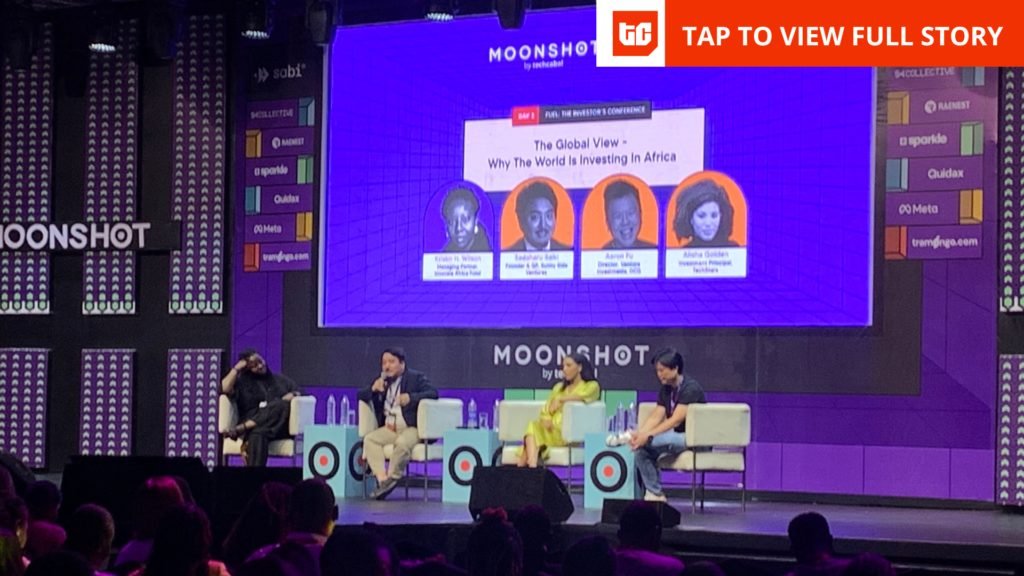

Founders need to recognize that what may be successful in African markets might require significant adjustments to flourish in regions like LatAm and Southeast Asia, as noted by Sadaharu Saiki, founder & GP at Sunny Side Ventures.

For instance, TymeBank, which originated in South Africa and has expanded to the Philippines, Vietnam, and Indonesia, often highlights the parallel macroeconomic conditions in Africa and Southeast Asia. However, developing a successful product demands more than just similar market dynamics—it involves forming strategic partnerships with local entities.

According to Aaron Fu, director of venture investments at DCG, leveraging the expertise of those who understand the market better through well-thought partnerships is crucial.

Given the increasingly competitive and somewhat saturated African market, foreign markets are now appearing more appealing to startups. To effectively tap into these markets, a combination of patient capital, profound market knowledge, and strategic partnerships with complementary synergies will be required.

Leave a Reply