In the realm of economic development in Africa, the focus extends beyond mere population growth projections. To truly elevate Nigeria’s status as a nation of pride, a well-established payment infrastructure, consistent policies, and effective governance are imperative. One critical aspect that demands attention is the hindrance posed by cross-border payment challenges, impeding seamless trade across the continent and limiting the growth potential for local enterprises and global investors.

The current scenario reveals a concerning trend where Nigeria’s dependency on imports, particularly from countries like China, is on the rise, while intra-African trade diminishes. This lack of regional trade exacerbates the reliance on global markets and weakens the local economy. Addressing the root causes of cross-border payment hurdles is crucial to fortify Nigeria’s standing in the global marketplace.

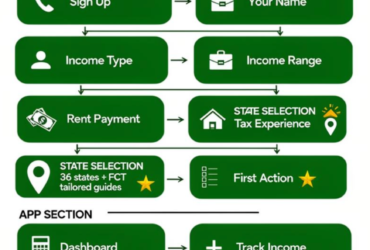

Issues such as policy inconsistencies across political regimes, currency interoperability challenges, and the burden of multiple taxes contribute to the complexities faced by Nigerian businesses. Streamlining tax policies and establishing a unified tax system would alleviate the financial strain on businesses, fostering a conducive environment for growth and sustainability.

Efforts to harmonize taxes and enhance collaboration among stakeholders are underway, aiming to create a more cohesive payment ecosystem. Initiatives like the proposed Tech Ecosystem Alliance seek to consolidate the voices within the tech community to influence policies effectively and ensure accountability from the government.

Furthermore, discussions around adopting a regional currency akin to the Euro in Europe are gaining traction, with initiatives like the Pan-African Payments and Settlement System (PAPPS) striving to facilitate direct trade in local currencies. Fintech companies like Verto play a pivotal role in addressing cross-border payment challenges, enabling seamless transactions and currency conversions across multiple countries.

By proactively tackling cross-border payment hurdles, aligning tax policies, and promoting currency interoperability, Africa can unlock new avenues for economic progress and emerge as a significant player in the global economy. Collaborative efforts among governments, private sector entities, and fintech innovators are essential in harnessing Africa’s potential and capitalizing on its demographic dividend. The time to act decisively is now to propel Africa towards a future of prosperity and sustainable growth.

Leave a Reply