A startup in Nigeria specializing in cross-border payments, Juicyway, has successfully secured $3 million in pre-seed funding. The company intends to utilize this funding to enhance its marketing and business development teams, upgrade its technology, and expand its operations in Nigeria, the US, the UK, and Canada.

The funding round was led by P1 Ventures, with contributions from Ventures Platform, Future Africa, Magic Fund, Microtraction, and several angel investors including Andrew Alli, Gbenga Oyebode, and Tunde Folawiyo.

Established in 2021 by Ife Johnson and Justin Ziegler, Juicyway acts as a marketplace enabling businesses and individuals to convert local currency to dollars and vice versa. The platform caters to both suppliers—businesses providing foreign currency (e.g., USD or CAD)—and buyers—businesses needing to purchase foreign currencies and execute outbound transfers. Juicyway earns revenue through transaction fees and spreads on its platform.

According to Ife Johnson, the co-founder and CEO of Juicyway, businesses approach them for two primary reasons. Some seek to convert local currency to US dollars for international payments through banking partners, while others aim to utilize the accounts provided by Juicyway to bring money into the continent and convert it into local currency for disbursements.

Juicyway’s fundraising comes at a crucial time when Nigerian businesses face challenges accessing foreign exchange for extensive international transactions. The company is among several Nigerian startups striving to address the country’s cross-border payment issues.

Juicyway offers businesses the option to conduct cross-border payments using stablecoins like Tether and USDC, positioning itself as a hybrid decentralized finance (DeFi) and traditional finance (TradFi) payments startup. Upon onboarding, businesses can choose to open a US Dollar (USD), Canadian Dollar (CAD), or stablecoin wallet.

Juicyway facilitates liquidity exchange between Customer A, who deposits naira to acquire dollars, and Customer B, who brings in dollars, without direct involvement in the transactions. Businesses can set selling prices and order limits for their foreign currencies, allowing other businesses in need of FX to purchase them if the prices align. This market-driven pricing model offers businesses favorable FX rates.

Ife Johnson highlighted the challenge businesses faced in finding near-instant, cost-effective, and compliant solutions for converting local currency to foreign currency. Juicyway aims to bridge this gap.

Since its inception in November 2021, Juicyway has operated discreetly, processing its initial $9 payment. The company reports a total payment volume (TPV) of $1.3 billion from over 4,000 clients.

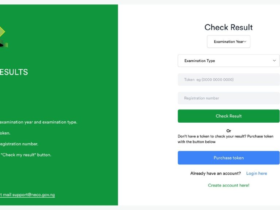

Juicy

Leave a Reply