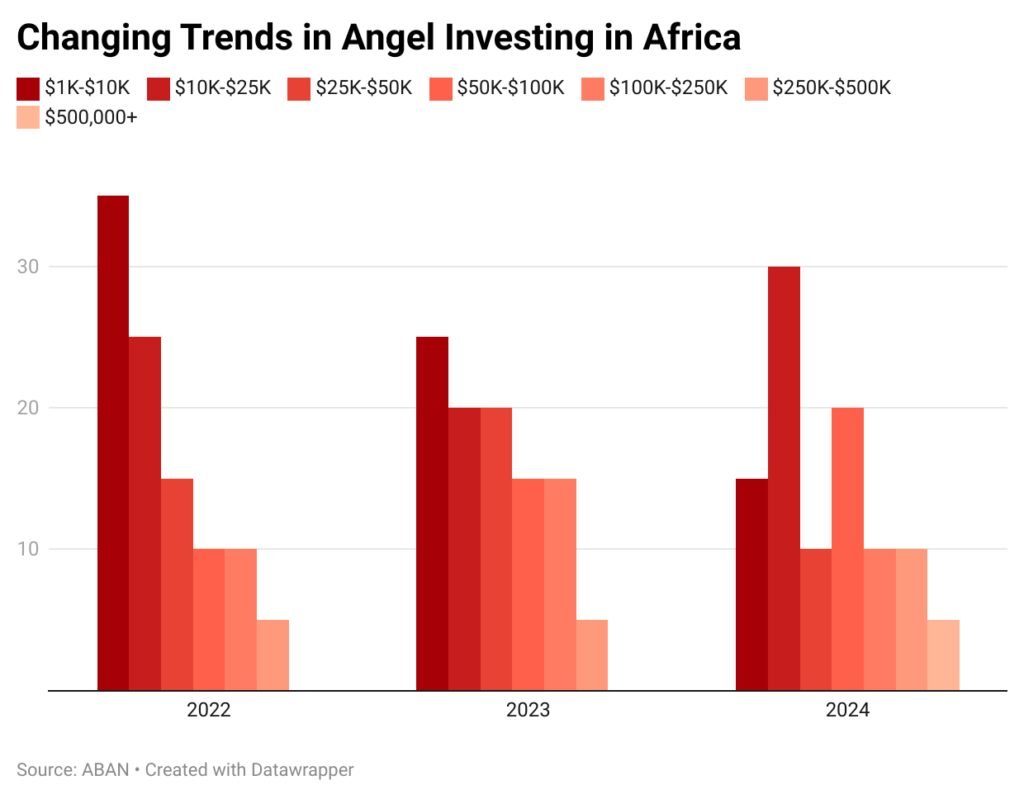

In a recent report by the African Business Angel Network (ABAN), it was revealed that a significant percentage of angel investors in Africa have invested less than $25,000 in startups between 2022 and 2024. This cautious approach indicates a certain level of risk aversion within the continent’s startup ecosystem.

The report, based on a survey of over 110 angel investors supporting African startups, sheds light on key trends in early-stage funding. Collaboration with Briter, a business analytics platform focused on startup funding, also contributed to the data collection process.

While most angel investments fall below the $25,000 mark, there has been a gradual increase in the number of investors committing amounts ranging from $50,001 to $250,000. This shift suggests a growing interest in higher investment brackets.

Angel investment plays a critical role in funding early-stage startups, particularly in regions where access to venture capital is limited. However, the inherent risks associated with these investments, often in unproven business models, lead to a cautious approach. Despite the challenges, startups require funding to expand and realize their growth potential. The report emphasizes the need for enhanced education and access to reliable data to help investors make well-informed decisions and mitigate perceived risks.

The report also highlights the diverse approaches of African angel investors based on their risk tolerance and investment objectives. A significant portion opt for equity investments through tools like Simple Agreements for Future Equity (SAFE), while others prefer debt instruments for quicker returns. The shift towards structured investment vehicles, such as angel syndicates, indicates a move towards more collaborative and risk-sharing strategies among investors.

Angel investors in Africa are often motivated by factors beyond financial gains, with a focus on job creation, poverty reduction, youth and women empowerment, and climate solutions. There is also a growing preference for technology-driven startups, aligning with broader trends in the venture capital landscape where sectors like fintech, e-commerce, and energy attract substantial funding.

As the African angel investment sector evolves, there is an increasing emphasis on education, data-driven decision-making, and network building to instill confidence and encourage larger investments in the future. The emergence of more angel networks providing training and improved data access is demystifying angel investing and expanding its reach across the continent.

Leave a Reply