In recent news, a Nigerian startup specializing in automotive spare parts, vehicle repairs, and maintenance services has made the decision to downsize its team due to challenging macroeconomic conditions and foreign exchange volatility within Nigeria. The company has not disclosed the exact number of employees affected by the layoff, but it has been confirmed that some full-time employees will be transitioning to contract roles, with severance pay equal to one month’s salary.

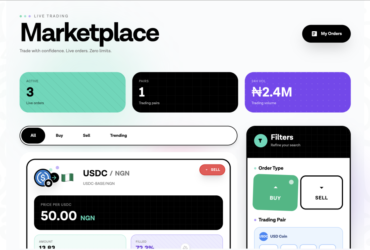

The startup, founded in 2021, aimed to transform Nigeria’s auto repair market by connecting vehicle owners with third-party workshops. Despite early success and partnerships with notable clients, the company has encountered difficulties due to rising inflation and the increased cost of importing spare parts caused by foreign exchange fluctuations. These challenges have prompted competitors to explore new revenue streams to adapt to the economic pressures.

While the company cited Nigeria’s economic environment and foreign exchange risks as reasons for the restructuring, former employees have highlighted ongoing financial struggles within the organization, including delayed salaries, difficulties with rent payments, and key resignations in critical roles.

Furthermore, despite securing pre-series A funding to expand its services, the company allegedly failed to deliver on promised initiatives, such as developing an app to support inventory financing and streamline operations. The inability to meet these goals has raised doubts about the startup’s ability to fulfill its ambitious plans.

Mecho Autotech’s challenges are not unique in Nigeria’s startup ecosystem, particularly for businesses reliant on imported goods. The current landscape of soaring inflation, currency devaluation, and reduced consumer spending power has made survival increasingly difficult for tech-driven ventures like Mecho Autotech. As the industry continues to evolve, competitors and peers of Mecho will need to adapt quickly by exploring new revenue models and operational efficiencies to withstand the country’s turbulent economic climate.

Leave a Reply