During 2024, there was a notable increase in the use of bank transfers by Nigerians as digital payments continued to gain popularity following a cash shortage in 2023.

Although cash remains the primary payment method in Nigeria, the Central Bank of Nigeria (CBN) reported in a June 2024 document that Nigerians are leaning towards digital payment methods, marking a shift away from traditional cash transactions.

The volume and value of instant online transactions saw a significant rise to 5.63 billion and ₦476.89 trillion in the first half of 2024, up from 3.5 billion and ₦256.85 trillion in the same period of 2023. This indicates a 60% increase in transaction frequency and an 85% increase in transaction value.

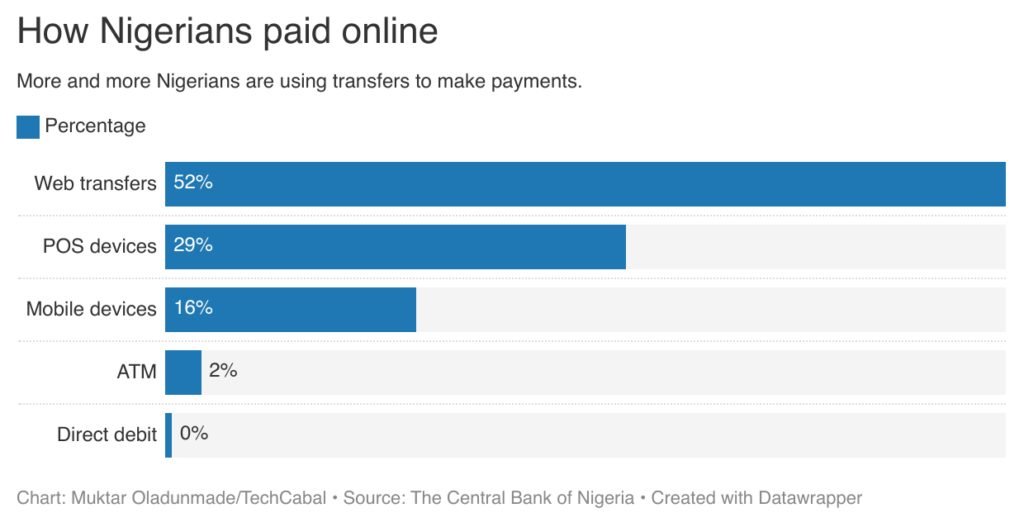

Bank transfers are the most preferred mode of payment among Nigerians for online transactions, accounting for over 51% of total online payment transactions, as per the Central Bank of Nigeria.

Following bank transfers, POS devices represent 28.5% of transactions, while mobile devices contribute 15.5%. ATMs come in fourth at 2.2%, with direct debit accounting for just 0.44%.

Bank transfers are favored by many Nigerians due to their instant nature, especially for small payments, and with the emergence of fintech companies like OPay, PalmPay, and Moniepoint, they have become popular choices for transactions.

Recognizing the prevalence of transfers in online payments, several fintech companies have developed products to capitalize on this trend. For instance, Paystack has partnered with various Nigerian banks and fintech firms to facilitate direct online payments from customer accounts, given that transfers made up over half of all transactions processed in 2023.

POS transactions have shown remarkable growth over the past five years

In 2019, POS transactions were valued at ₦3.21 trillion. Within just five years, these transactions have surged to over ₦85 trillion, marking a substantial 2576.44% increase.

The growth of POS transactions has been primarily driven by the agency banking sector, which now boasts 1.5 million agents, along with fintech companies like OPay, Moniepoint, and PalmPay.

In the first half of 2024, over 6 billion transactions were conducted via POS devices, averaging a billion transactions per month, over 33 million daily, and more than 1.3 million per hour.

How frequently do Nigerians use cheques today?

Usage of cheques has dwindled, with a 13% drop in cleared cheques from 7.92 million in the second half of 2023 to 6.88 million in the first half of 2024. Although the value saw a slight 2% increase from ₦8.553 trillion to ₦8.741 trillion, customers are increasingly opting for electronic and alternative payment channels over cheques.

ATMs may become obsolete in five years

ATMs in Nigeria often display “Out of Service” messages, reflecting their unreliability and scarcity across the country. With only 16,000 active ATMs in Nigeria and a banking population of 106 million adults, the country would need nearly 70,000 ATMs to meet demand.

Due to this scarcity and unreliability, the value of ATM transactions dropped by 10% to ₦12 trillion, significantly lower than the value of POS transactions.

Although the volume of ATM transactions increased by 1% from 492.76 million in the second half of 2023 to 496.44 million in the first half of 2024, this growth contrasts with the decline seen over the past five years when Nigerians conducted 839.8 million transactions with ATMs.

While other payment methods have flourished over time, ATM transactions have decreased, suggesting a potential obsoletion of ATMs in the near future as digital alternatives gain more traction.

Overall, 2024 was a significant year for Nigeria’s payment landscape, witnessing a notable shift towards digital payment methods driven by increased internet penetration, smartphone usage, and a preference for convenient and secure transaction options.

Leave a Reply