Despite recent policy changes by Nigeria’s Central Bank, there is a consensus in the financial industry that commercial banks are losing the competition for cash accessibility. Traditional banking channels like ATMs and over-the-counter withdrawals are being overshadowed by banking agents, commonly known as POS agents, as the preferred method to access cash nationwide.

In December, the CBN implemented withdrawal limits on POS agents and warned of penalties for banks caught selling mint notes to currency dealers. However, these actions have not significantly reduced the reliance on POS agents.

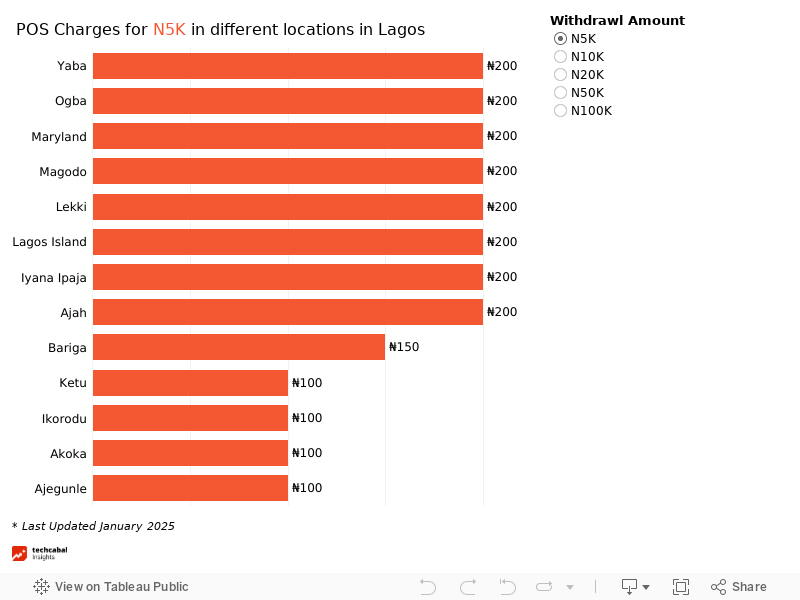

In response to the imposed limits, many POS agents have raised their withdrawal fees, a move not regulated by the CBN. This increase in fees has been particularly noticeable in certain areas of Lagos, leading to higher costs for cash withdrawals for customers.

Interviews with POS agents and customers have revealed a wide variation in withdrawal fees depending on the location. While some agents have raised their charges, others have maintained their previous rates. The chart below demonstrates these differences:

*Explore the dropdown in the image to view withdrawal charges for varying amounts.

Leave a Reply