When it comes to cross-border payments for African businesses and consumers, four key factors must be addressed: speed, affordability, accessibility, and reliability.

For small businesses, instant payments are crucial for maintaining cash flow. Delays in payments can lead to disruptions in operations and financial stability. Similarly, freelancers rely on timely international payments to sustain their income.

Affordability plays a significant role in the choice of payment solutions. High fees can deter businesses, especially small and medium enterprises with narrow profit margins. Transparent fees and cost-effective solutions are preferred by businesses, with some fintech platforms successfully reducing transaction costs and offering predictable exchange rates.

Accessibility is essential as not everyone has access to traditional banking services. Mobile money has become a prevalent method in Africa, providing solutions that cater to the needs of businesses and consumers, whether through mobile wallets, bank transfers, or local agents like M-Pesa, which has simplified payment processes even for micro-businesses in rural areas.

Trust is paramount in cross-border payments. Businesses and consumers need assurance that their funds are secure, transactions are safe, and payments will be delivered on time without any issues. Fintech platforms can build trust by investing in fraud prevention measures and real-time tracking features.

By addressing these fundamental aspects, solutions can facilitate growth, establish trust, and streamline cross-border payment processes.

Enhancing Speed and Transparency

The key to effective solutions lies in simplicity. Providers should focus on eliminating unnecessary steps in the payment process to enhance user experience. Similar to Amazon’s one-click ordering, streamlining payment procedures can significantly improve efficiency. Introducing blockchain technology can boost transaction speed and transparency, addressing concerns about payment visibility and creating a secure, shared ledger.

Transparency also involves effective communication with users. Real-time tracking mechanisms offer visibility into payment progress, similar to tracking a package, which instills confidence in users. Collaboration with local banks, mobile money platforms, and regional systems is essential to ensure fast and reliable payment transfers, reaching even remote areas effectively.

Challenges Faced by SMEs in Cross-Border Payments

Uncertainty, rather than technical issues, poses the biggest challenge for SMEs. The unpredictability of payment timelines and costs can hinder business growth and confidence. Quick clearance of payments is vital for maintaining cash flow, supplier relationships, and overall competitiveness in the market.

Understanding Customer Preferences

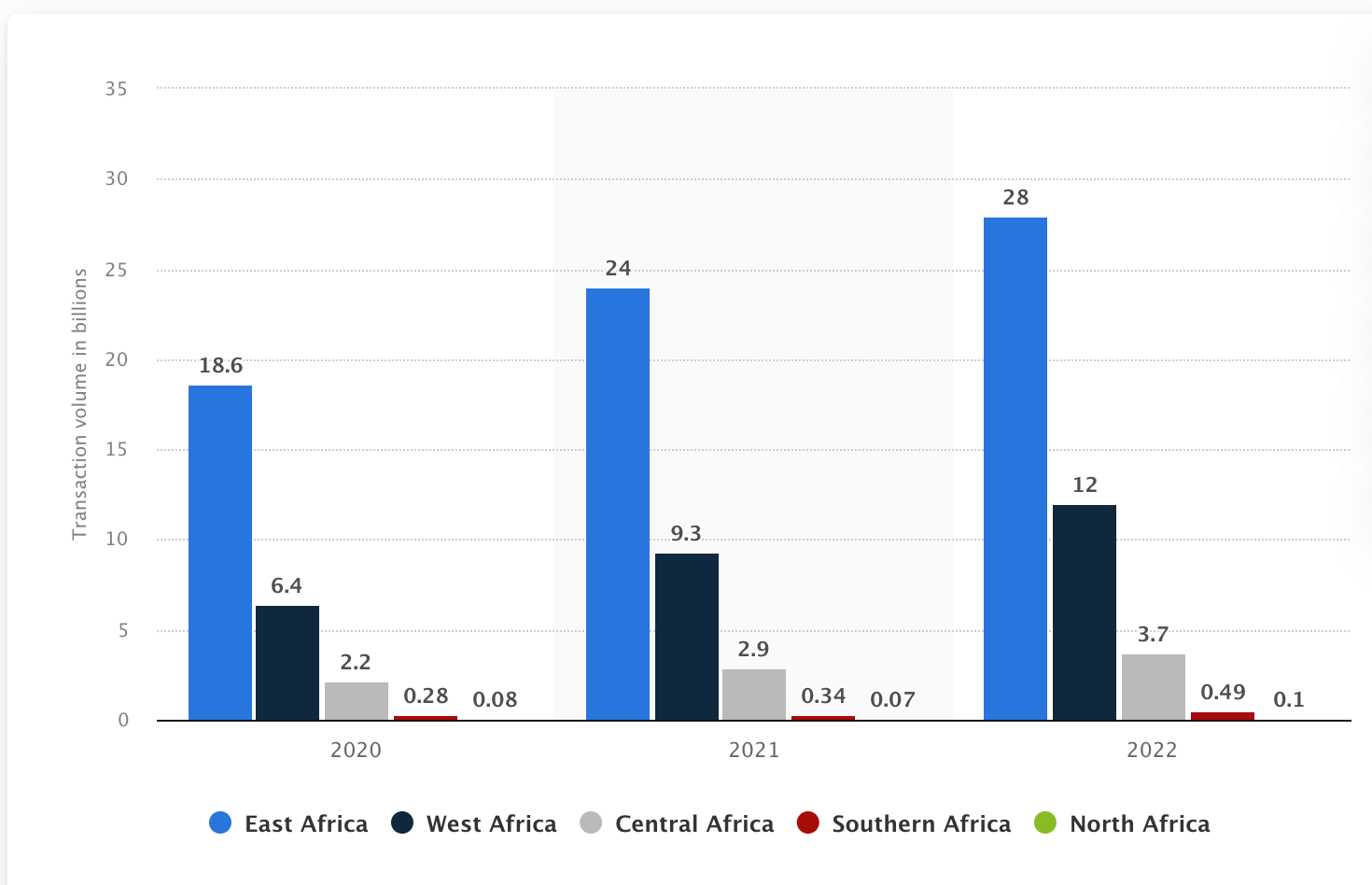

Customer preferences vary across regions in Africa. East Africa, known for its embrace of mobile money solutions like M-Pesa, prioritizes fast and accessible payment methods that integrate seamlessly with mobile wallets. West Africa, particularly Nigeria, leans towards bank transfers, while Southern Africa displays a mix of digital wallets, bank transfers, and card payments. Francophone Africa relies heavily on regional solutions like GIM-UEMOA and local digital platforms, emphasizing the importance of tailored solutions for specific regions. North Africa, particularly Egypt and Morocco, favors bank transfers and digital wallets, influenced by strong trade ties with Europe.

Localizing Products and Services in Cross-Border Payments

Product adoption is accelerated when solutions cater to local needs such as language, currency, and preferred payment methods. Avoiding constant currency conversions and enabling transactions in local currencies simplifies operations and fosters global transactions. Effective localization involves aligning services with existing customer behaviors and preferences, as exemplified by the success of M-PESA in Kenya.

You can access the full report for further insights.

__________________

For reference, Nimide Fala is the Vice President of Client Experience at Zest, a subsidiary of Stanbic IBTC Holdings, with expertise in blending creativity and data for compelling storytelling and strategic marketing. Eytan Messika is the co-founder of Nilos, a fintech startup specializing in treasury operations across crypto and fiat currencies.

Leave a Reply