This content was contributed by an industry expert as part of a comprehensive report on emerging trends in cross-border payments.

Utilizing existing payment channels like mobile money has proven to be an effective marketing strategy for driving cross-border payment solutions in Africa. Local fintechs and banks have successfully leveraged these methods to facilitate payments and payouts, enabling quicker market penetration for both local and global companies seeking to expand in the region.

Collaborating with local and pan-African fintech influencers has also emerged as a successful tactic for promoting products in new markets. By partnering with influencers who have strong connections with the target audience, companies can establish trust and credibility more efficiently than through traditional advertising methods.

Customizing messaging to suit the language and cultural context of each market is essential for effective communication. Understanding cultural nuances and adapting marketing strategies accordingly can significantly impact the reception of a brand in diverse regions across the continent.

Thought leadership plays a crucial role in educating stakeholders and regulators about the complexities of the industry, ultimately building trust and confidence in cross-border payment solutions. Sharing unique perspectives and insights can differentiate a company and establish credibility in the market.

Measuring the success of growth campaigns in the fintech industry involves monitoring metrics such as total payment volume, client numbers, and margins. These indicators provide valuable insights into the performance and relevance of payment solutions in the cross-border space.

Partnerships and collaborations with market leaders, both regionally and locally, are instrumental in driving growth and understanding market dynamics. Working with telcos for client acquisition and technical integrations can further enhance the distribution and accessibility of fintech solutions for cross-border payments.

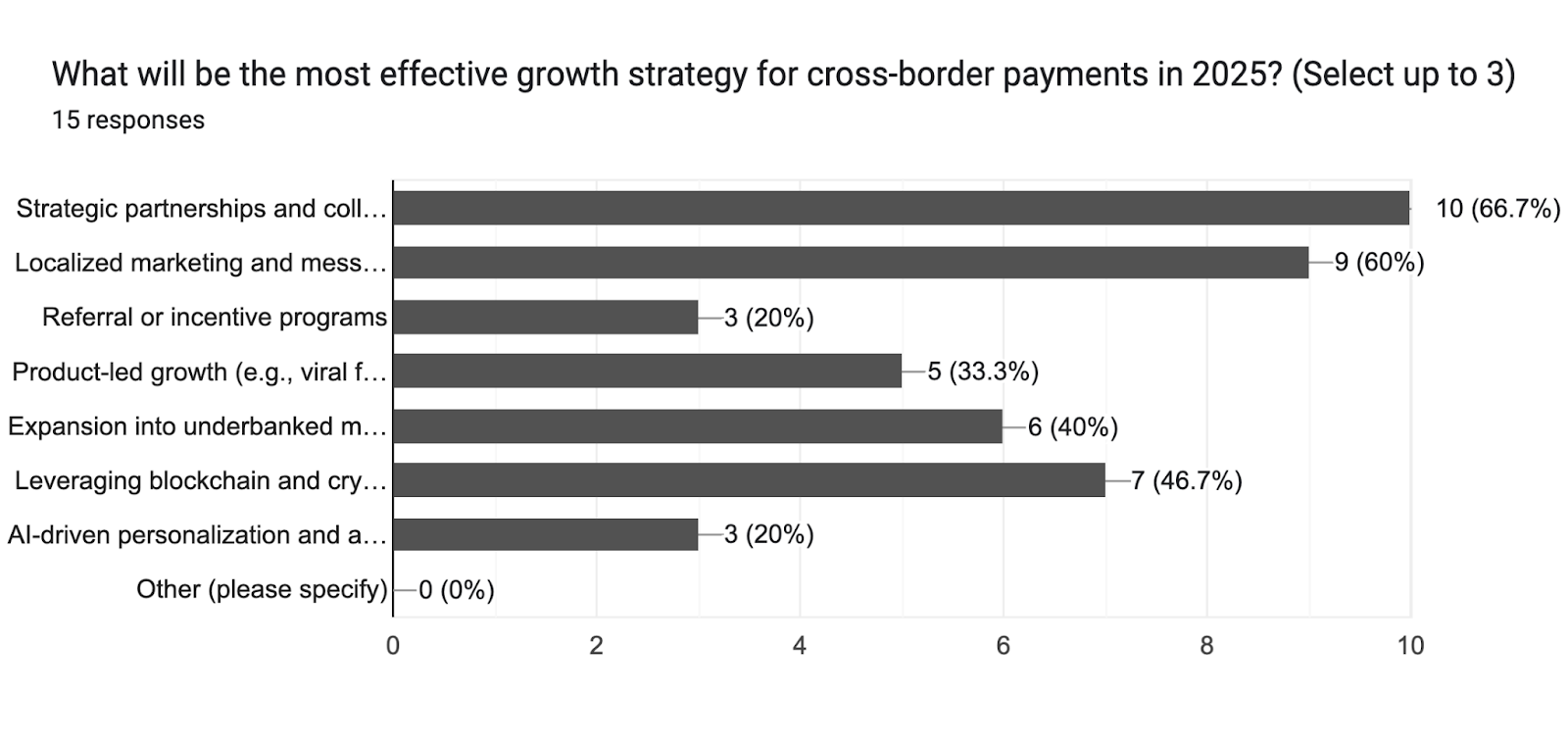

The study conducted on growth strategies for 2025 revealed that partnerships, localized marketing campaigns, and leveraging blockchain technology are key drivers of growth in the cross-border payments sector. These strategies focus on expanding reach, resonating with target audiences, and enhancing the efficiency of payment processes.

Marketing channels such as influencers, content creation, and performance marketing are anticipated to be crucial for driving growth in cross-border payments. Tailoring content for different markets and utilizing various marketing tools can help position products effectively for growth and customer acquisition.

Enhancing transaction speed, offering competitive fees, and ensuring secure payment options are identified as top tactics for customer acquisition in the cross-border payments sector. Prioritizing user experience and security measures can significantly impact customer trust and retention.

For a more detailed analysis of the survey findings and growth strategies in cross-border payments, you can access the full report through the provided link.

Leave a Reply