In 2017, a crypto startup was founded with the vision of offering a crypto payment gateway, a cross-border remittance product, and a crypto trading platform. The startup experienced significant growth, processing millions of transactions annually until 2021.

A pivotal event occurred in February 2021 when the Central Bank of Nigeria prohibited banks from facilitating crypto transactions, leading to the closure of crypto company accounts overnight. This action drove the once-thriving crypto sector underground, causing significant challenges for local startups like Bitfxt.

During the 2017 bull market, the demand for digital assets surged in Nigeria, but existing exchanges were ill-equipped for the local market, making it challenging to purchase crypto with Naira. Bitfxt emerged as a platform enabling Nigerians to buy crypto with Naira, although it struggled financially due to insufficient revenues.

Foreign exchanges like Binance, Huobi, and OKX entered Nigeria in 2020, intensifying competition for local startups. Bitfxt faced difficulties raising capital and eventually rebranded to Boundlesspay in response to the regulatory environment and market challenges.

The crypto ban forced local startups to innovate or pivot their business models. Many startups either shut down, were acquired, or pivoted due to regulatory obstacles and funding shortages. P2P platforms became popular, allowing users to control liquidity while startups facilitated transactions.

Despite regulatory uncertainties, surviving crypto startups explored offshore bank accounts and alternative liquidity management solutions. Some obtained licenses from European countries or implemented verification checks for traders to enhance compliance.

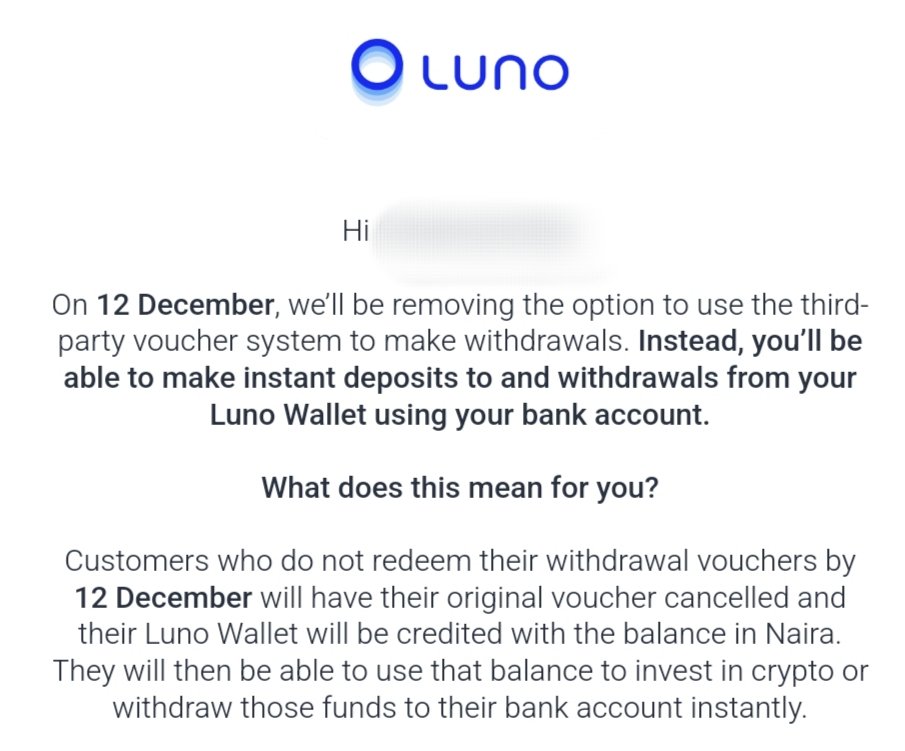

The lifting of the crypto ban in December 2023 marked a shift in Nigeria’s regulatory stance, with provisional licenses issued to some startups in 2024. Compliance with regulations remained crucial for the survival of crypto startups, as they navigated the evolving regulatory landscape in collaboration with regulators.

The future outlook for crypto startups in Nigeria hinges on leveraging blockchain technology to address real-world challenges and ensuring compliance with regulatory frameworks. Collaboration between startups and regulators will be essential in shaping a more defined crypto landscape in the country in the coming years.

Leave a Reply