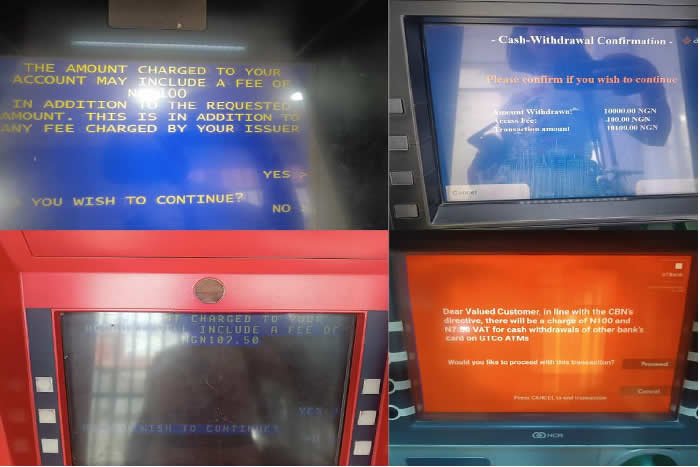

Banks have begun to stock their ATMs with cash in preparation for the implementation of a new N100 charge for transactions starting on March 1. The Central Bank issued a circular on February 10 outlining the revised fees. While withdrawals from one’s bank’s ATMs will remain free, customers using other bank ATMs will face a N100 charge per withdrawal of N20,000 or less at on-site ATMs. Off-site ATMs will have an additional surcharge of up to N500 per transaction.

For international ATM withdrawals, charges will be based on cost recovery, passing on the exact fee from the international acquirer to customers. During a check in Lagos, banks were observed to have loaded their ATMs with cash to reduce the need for customers to use other bank ATMs and incur extra charges.

Customers are expressing dissatisfaction with the new charges, citing increased financial burdens. Some have taken to social media to voice their concerns about the additional costs associated with ATM transactions. The Trade Union Congress and Socio-Economic Rights and Accountability Project have both called for the suspension of the charges, urging Nigerians to reject what they consider exploitative policies.

To avoid the ATM charges, the Central Bank recommends using one’s bank’s ATM or exploring alternative payment channels like mobile apps and POS devices. The organizations have appealed to President Bola Tinubu to intervene and halt the implementation of the charges pending further review.

Leave a Reply