In April 2020, a new angel investor syndicate was established in Dublin, focusing on investing in early-stage African startups. The syndicate gained momentum following the acquisition of a Nigerian investment startup called Bamboo and the interest generated by Paystack’s acquisition by Stripe.

As interest grew, challenges arose in managing the syndicate efficiently. Yewande Odumosu joined the team and recognized the need for a dedicated fund to support early-stage founders, leading to the creation of the HoaQ Fund alongside the syndicate.

The fund now invests in founders with technical expertise and global scaling potential, aiming to provide between $25,000 and $50,000 to 30 selected startups. Recent successes include exits from startups like Baseline and Raenest, showcasing the syndicate’s commitment to transparency and investor returns.

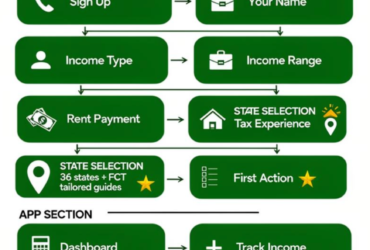

The syndicate and fund operate in parallel, catering to investors with different preferences for active or passive investing. With a network of thousands of operators and investors, HoaQ provides more than just capital to startups, offering guidance, connections, and exposure.

The fund’s core mission is to back tech startups in Africa and its diaspora, focusing on founders with a clear vision and the ability to execute. While sector-agnostic, the fund prefers areas where it can leverage its expertise and network for added value.

Key lessons learned include the importance of market opportunity, adaptability, and a founder’s track record. HoaQ’s approach emphasizes hands-on support, strategic partnerships, and a founder-first mentality to differentiate its value and drive success.

Looking ahead, the fund aims to continue supporting exceptional founders, achieving profitable exits, and maintaining its reputation in the ecosystem. Continuous learning, strong relationships, and personalized support are key to HoaQ’s strategy for success.

Leave a Reply