Advertisements can be seen all around Nairobi, from billboards to social media. Payless Africa, a fintech-neobank based in Nairobi, has been making waves in the Kenyan fintech scene over the past six months. Founded in 2024, the company is focusing on aggressive marketing to gain visibility and market share in a space dominated by M-PESA and over 200 other fintech players targeting young urban customers.

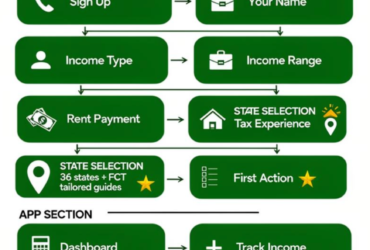

Payless aims to provide a seamless experience for users by offering a digital platform that combines money transfers, savings, and payments with a focus on financial literacy. Neobanks like Payless position themselves as more affordable and flexible alternatives to traditional banks, catering to the digital-first generation.

Operating under the regulatory cover of Webtribe (Jambopay), Payless does not hold a direct licence from the Central Bank of Kenya. The company plans to approach regulators directly as it grows but currently benefits from Webtribe’s compliance structure.

In addition to its digital services, Payless has signed agreements with three banks to develop products that align with Gen Z’s financial behavior. These partnerships will introduce various financial services within the Payless app, integrating them seamlessly into users’ daily transactions.

Payless generates revenue primarily from transaction fees, offering free peer-to-peer transactions to users under 24 and on transfers below a certain amount to encourage engagement. The company plans to introduce new products like Payless Y and Payless Z to diversify its revenue streams in the future.

Competition in Kenya’s neobanking sector is fierce, with players like M-PESA and other neobanks vying for market share. Payless differentiates itself by focusing on embedded financial services that support everyday decisions, targeting individuals for savings, cards, insurance, and investments.

While Payless has seen significant growth through organic means and partnerships, the company plans to engage investors in 2025 to expand its product offerings and market reach. The neobank aims to prove its sustainability and profitability to attract funding as it continues to scale.

With over 500,000 app downloads and active users, Payless has made strides in the Kenyan fintech landscape. However, the company will face challenges as it seeks direct licensing and expands into new markets, navigating regulatory compliance, competition, and profitability to ensure its long-term success.

Leave a Reply