Moneda Invest Africa has teamed up with meCash to transform Africa’s financial ecosystem, specifically focusing on payments and credit access. The unveiling of the strategic partnership and the “Musa” app took place at the Moneda Experience event on March 14, 2025, in Lekki, Lagos.

The event gathered important figures, including key stakeholders from Moneda and meCash, investors, and members of the press to discuss the future of credit access for essential SMEs.

A Vision for Financial Inclusion

Moneda Invest Africa focuses on energy, agriculture, and mining, offering alternative credit and execution expertise to vital SMEs in Africa’s natural resource value chains. meCash, a platform for cross-border payments, complements this by facilitating seamless financial transactions globally.

The aim is to provide credit for businesses fulfilling contracts without requiring collateral, particularly SMEs involved in natural resource sectors like energy, agriculture, and minerals.

According to Ejike Egbuagu, GCEO of Moneda, empowering businesses with access to credit is crucial for transforming industries and improving lives.

For meCash, this partnership signifies a commitment to enhancing financial inclusion, secure payments, and cross-border transactions, especially for SMEs driving real impact.

Addressing the Challenges of SME Financing

Financing SMEs in Africa presents challenges such as high default rates and regulatory obstacles. meCash’s expertise in financial infrastructure helps manage these risks by ensuring efficient fund disbursement, secure payments, and regulatory compliance across various African markets.

Ensuring seamless regulatory adherence and risk management for cross-border transactions is a key focus for meCash in supporting SMEs.

MUSA aims to revolutionize access to capital by offering a structured credit model tailored for Africa’s natural resource sectors, prioritizing structured financing and risk-managed disbursement for essential SMEs across the continent.

Technology-Driven Transparency

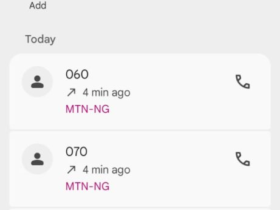

The event showcased the “Musa” app, demonstrating real-time transparency, transaction monitoring, and risk-sharing capabilities. The app is designed to democratize finance access

Leave a Reply