SpaceX plans to eliminate SIM cards and roaming by directly linking phones to its satellites. In this vision, your smartphone will connect directly to satellites orbiting Earth — providing internet access in areas without reliable network coverage.

The plan could change how people connect to the internet worldwide. Turning the idea into reality will take time, money, and major technical effort

A $17 billion leap toward Direct-to-Phone connectivity

In September 2025, SpaceX announced a $17 billion deal to acquire wireless spectrum licences from EchoStar, one of the largest satellite spectrum sales ever recorded. The transaction includes the AWS-4 and H-block bands, key for 4G and 5G mobile networks. These frequencies will enable Starlink satellites to connect directly to standard mobile phones, bypassing cell towers and expanding coverage worldwide.

SpaceX will pay $8.5 billion in cash and another $8.5 billion in stock, while taking on about $2 billion of EchoStar’s debt. The deal grants SpaceX full control of the spectrum required to build its direct-to-cell satellite network on a global scale.

SpaceX President Gwynne Shotwell said the investment will eliminate mobile dead zones and power a new generation of Starlink satellites with enhanced data capacity and improved phone compatibility.

SpaceX will then become the first company to control every layer of mobile delivery from orbit, positioning it to challenge telecom heavyweights like AT&T and Vodafone in the coming years.

Musk said at the All-In Summit in September 2025 that SpaceX is building new satellites and smartphone chips to support direct phone-to-satellite links.. Musk described it as a single mobile network that works anywhere in the world.

“The net effect,” Musk said, “is that you should be able to watch videos anywhere on your phone.” However, he noted that signals may not work under metal roofs or underground, though they’ll function in most typical homes.

Next Wave continues after this ad.

How Starlink’s “Direct to Cell” works

Starlink’s direct-to-phone satellite service—also called “Direct to Cell”—works by allowing standard 4G LTE phones to connect directly to a Starlink satellite in orbit, with no need for a Starlink dish or special hardware. The company has launched new satellites equipped with modems known as eNodeBs, which function like mobile towers in orbit.

When users are outside terrestrial coverage, their phones connect to a passing satellite for basic services, such as texting, voice calls, and eventually, limited mobile data. The satellites relay signals through Starlink’s existing network to ground stations, providing coverage where there’s clear sky access.

As for pricing, Starlink’s direct-to-phone service is expected to be cheaper than traditional satellite phones, which require expensive hardware and charge high rates for calls and data. However, it won’t compete directly with Starlink’s dish-based home internet in terms of speed or capacity. Instead, Direct to Cell will focus on coverage and accessibility, with early launches offering basic texting and calling before expanding to mobile data. Pricing will likely be added as an add-on to current mobile or Starlink plans, rather than serving as a full broadband replacement.

Next Wave continues after this ad.

Starlink’s global ambition

SpaceX goal is to turn Starlink into a single global carrier, where a single account works anywhere, without requiring roaming or SIM changes. “You should be able to have a Starlink account that works at home and on your phone,” Musk said, describing it as a “comprehensive, high-bandwidth, direct-to-cell solution.”

If it works, the model could disrupt telecom systems by replacing physical towers and roaming deals with satellite links. For users, this means easier and more affordable internet access. For telecom operators, it presents both risks and opportunities.

Rivals such as AST SpaceMobile, Lynk Global, and Apple’s Globalstar partnership are scrambling to keep pace. AST SpaceMobile, supported by AT&T and Vodafone, is pursuing full 4G/5G broadband from orbit but faces significant technical and regulatory challenges. Lynk Global is focusing on smaller markets and emergency coverage through regional partnerships, while Apple and Globalstar remain confined to limited use cases, such as emergency SOS messaging. Yet, each competitor contends with higher costs, slower rollout, and narrower scope than SpaceX’s vertically integrated model.

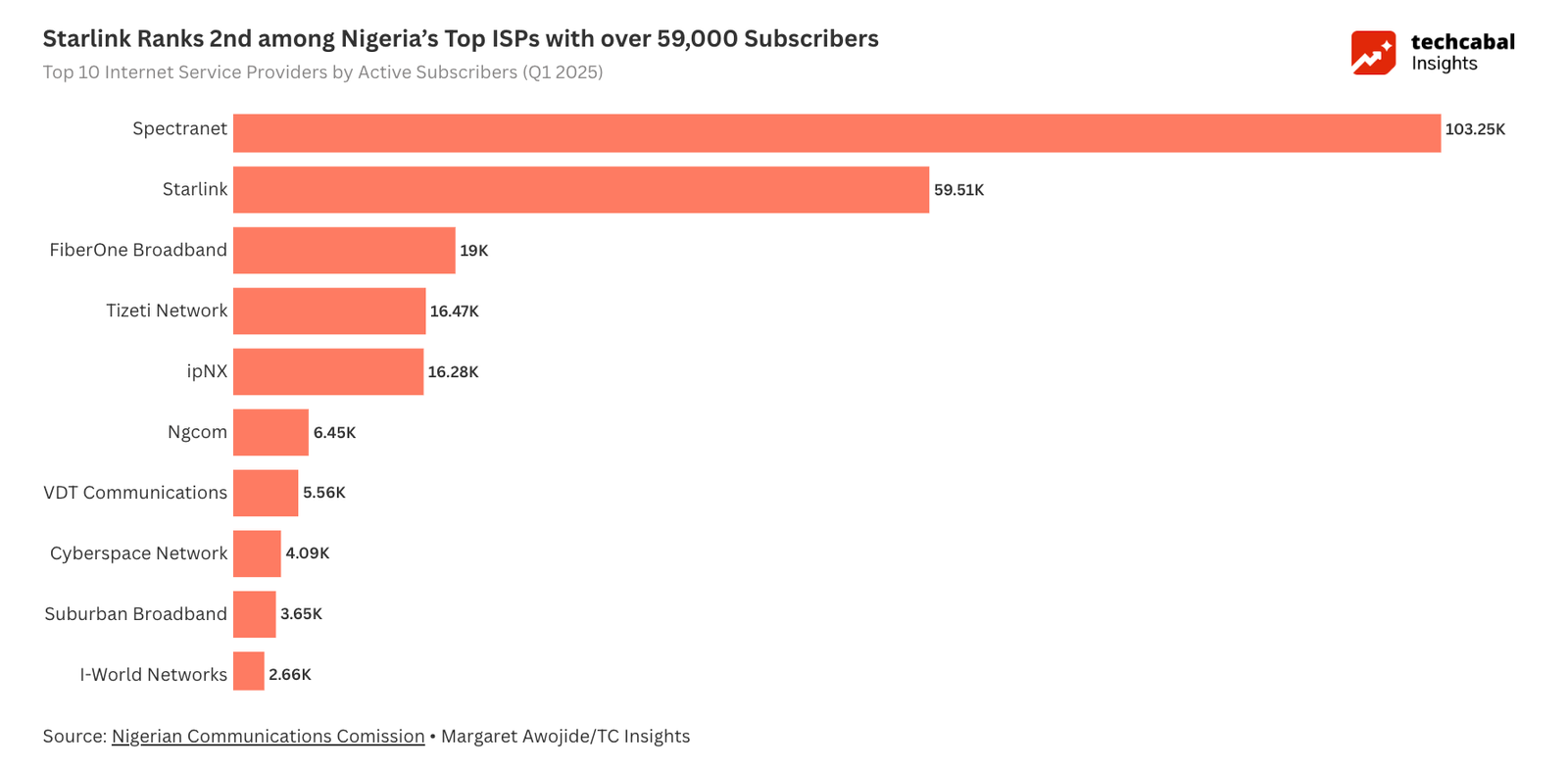

IStarlink Ranks 2nd among Nigeria’s top ISPs with over 59,000 subscribers

Starlink’s African challenge: Subscriber declines amid rising costs

Despite its global ambitions, Starlink’s growth in Africa has recently faltered. Subscriber numbers have declined in key markets, such as Nigeria, Kenya, and Rwanda, due to rising costs and the emergence of local competitors.

In Nigeria, Starlink lost an estimated 9–14% of its active users between late 2024 and early 2025, following a sharp increase in its monthly fees from around ₦38,000 to over ₦75,000, as well as a rise in hardware prices above ₦590,000. The hikes came amid soaring inflation, foreign exchange pressures, and network congestion in major cities like Lagos and Abuja, where Starlink even halted new sign-ups temporarily due to capacity limits. These economic and technical pressures prompted many users to cancel subscriptions or switch to cheaper fiber or 5G-based ISPs.

In Kenya, Starlink shed more than 2,000 users (around 10–11%) in early 2025 as consumers returned to local ISPs offering better pricing and faster speeds. The decline followed an initial surge in adoption during 2024, when Starlink helped restore connectivity during government-imposed internet blackouts. As conditions stabilised, users pointed to higher prices and slower speeds than local fibre options.

Next Wave continues after this ad.

In Rwanda, Starlink has seen smaller subscription declines, largely due to reduced subsidies and slower rural deployments. The company’s broader challenge across Africa remains the same — balancing affordability with network growth in an increasingly competitive broadband market.

The upcoming direct-to-cell technology could help Starlink rebalance its business model by shifting from costly hardware sales to a more flexible, service-based approach. Currently, Starlink’s African operations depend on expensive user terminals, priced around ₦590,000 ($400–$500), with monthly fees exceeding ₦75,000 ($50+). These high costs have driven user churn, particularly in price-sensitive markets like Nigeria and Kenya.

Direct-to-cell connectivity would remove this barrier by allowing users to connect via their existing 4G smartphones, eliminating the need for Starlink hardware and drastically reducing entry costs. Operationally, it would also enable faster and cheaper expansion, as satellites effectively serve as “cell towers in orbit.” This approach reduces reliance on ground infrastructure and distribution networks, allowing SpaceX to reach rural and remote communities more efficiently.

Ultimately, the model opens the door for tiered pricing strategies — keeping Starlink’s dish-based broadband as a premium home service while introducing mobile satellite access at a lower monthly rate, better suited to African consumers’ spending power.

Next Wave continues after this ad.

Regulatory implications

To deliver satellite broadband services in the 23 markets it currently operates in Africa, Starlink holds operational licences. In Nigeria, for example, it holds a Nigerian Communications Commission (NCC) licence to deliver satellite broadband, but offering direct-to-phone services introduces new regulatory challenges. The NCC treats satellite broadband and mobile connectivity under separate frameworks, meaning SpaceX would likely need additional authorisation for D2D or mobile satellite services.

For African mobile operators, the technology presents both risk and potential. It bypasses terrestrial infrastructure and challenges existing business models. Operators like MTN, Airtel, and Vodacom may have to pivot — exploring hybrid satellite partnerships and new digital services to stay relevant.

If regulators and telecom firms collaborate with SpaceX, the service could expand digital access across Africa — but it will face significant technical and policy challenges.

Next Wave ends after this ad.

Frank Eleanya

Senior Reporter

Thank you for reading this far. Feel free to email frank[at]bigcabal.com, with your thoughts about this edition of NextWave. Or just click reply to share your thoughts and feedback.

We’d love to hear from you

Psst! Down here!

Thanks for reading today’s Next Wave. Please share. Or subscribe if someone shared it to you here for free to get fresh perspectives on the progress of digital innovation in Africa every Sunday.

As always feel free to email a reply or response to this essay. I enjoy reading those emails a lot.

TC Daily newsletter is out daily (Mon – Fri) brief of all the technology and business stories you need to know. Get it in your inbox each weekday at 7 AM (WAT).

Follow TechCabal on Twitter, Instagram, Facebook, and LinkedIn to stay engaged in our real-time conversations on tech and innovation in Africa.

Leave a Reply