TymeBank, a digital bank based in South Africa with significant customer deposits, is set to expand its services to Indonesia by the end of 2024. This move marks the bank’s third venture into the Southeast Asian market, following successful launches in the Philippines in October 2022 and Vietnam in January 2024.

In Indonesia, TymeBank plans to introduce its lending product, Merchant Cash Advance, to Small and Medium Enterprises (SMEs) without immediately seeking a banking license. This approach mirrors its strategy in Vietnam.

The Chair of Tyme Group, Coen Jonker, expressed optimism about the potential for profitable growth in the small business lending sector in Indonesia and the broader region.

Founded in 2018, TymeBank caters to low-income earners and SMEs, and has received substantial backing from investors like Tencent, British International Investment, and Africa Rainbow Capital (ARC).

The company’s upcoming plans include raising a Series D round of $150 million and aiming for a listing on the New York Stock Exchange by 2028.

Indonesia, with its large number of SMEs and limited access to traditional financing, presents a lucrative market for TymeBank’s merchant lending services. The company’s successful track record in South Africa, where it has supported numerous small businesses, positions it well for expansion into Indonesia.

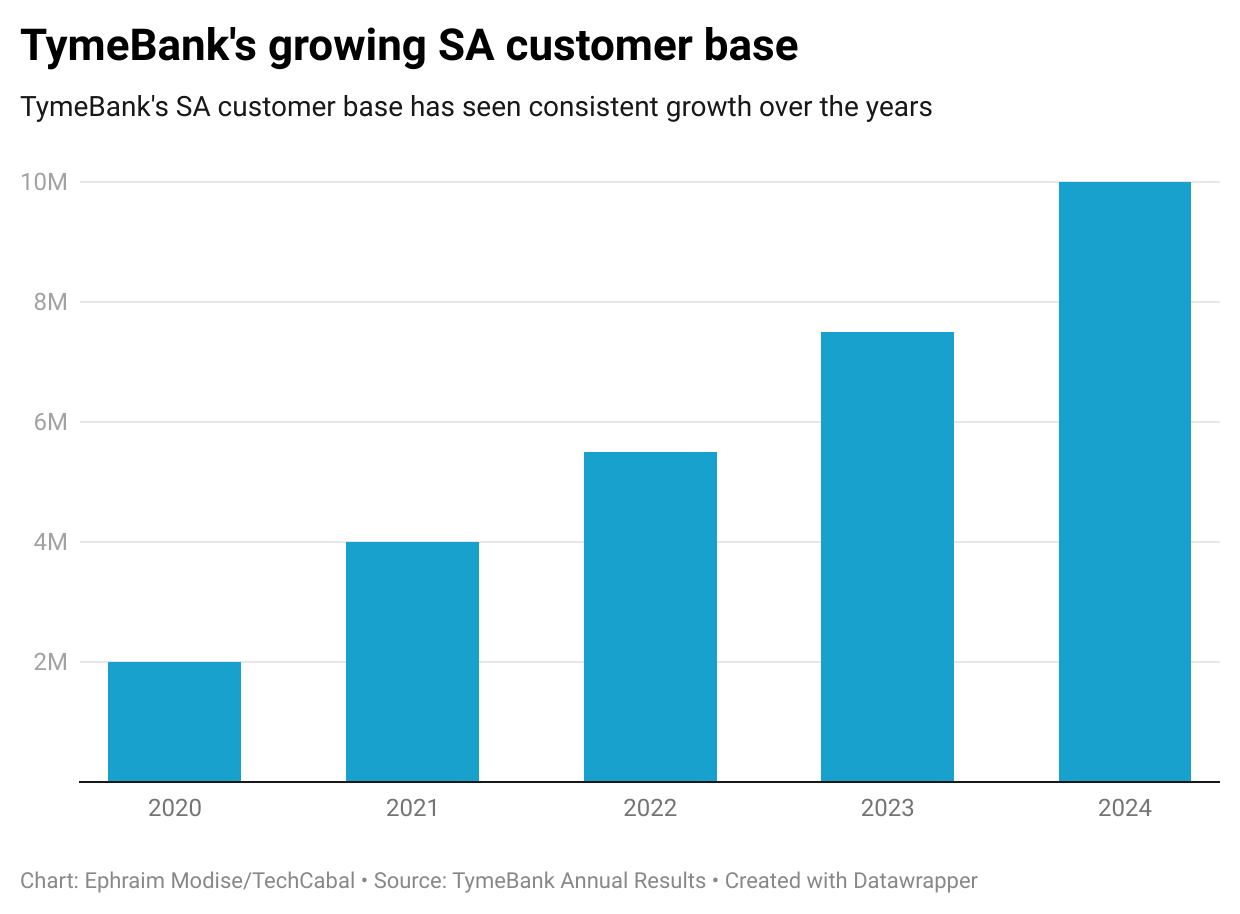

While TymeBank faced losses in the Philippines in its initial year of operations, it is optimistic about achieving profitability in the coming years. The company aims to reach millions of customers in South Africa and the Philippines by 2024.

With a keen focus on Southeast Asia due to favorable regulatory conditions and vast market potential, TymeBank remains open to the possibility of expanding its operations to other regions in the future, including Africa.

Leave a Reply