The Central Bank of Nigeria (CBN) and the Nigerian Communications Commission (NCC) have instructed banks to settle a ₦212.5 billion debt, which accounts for 85% of the total ₦250 billion owed to telecom operators for USSD charges, by December 31, 2024. This directive, outlined in a memo dated December 20, aims to address the prolonged disputes and delays in USSD payments.

Despite regulations mandating banks to handle USSD fees collection and remittance since 2021, several banks have been resistant. They argue that the charges are inequitable and criticize USSD technology as outdated.

Executives from Nigerian banks have expressed similar concerns, with some questioning the fairness of the fees imposed by telcos and the relevance of USSD technology in the modern era.

These challenges have led to the accumulation of a substantial USSD debt owed by banks to telecom operators, reaching ₦250 billion as of November 2024.

The recent directive aims to expedite the settlement of outstanding debts and enforce strict payment deadlines. Under the new guidelines, banks are required to settle 85% of new invoices within one month of receipt. Additionally, by January 2, 2025, banks and telecom operators must agree on a plan to clear 60% of all outstanding invoices before utilizing any telco’s USSD platform.

Failure to adhere to the directive may result in penalties such as fines, operational limitations, or other regulatory measures to ensure compliance.

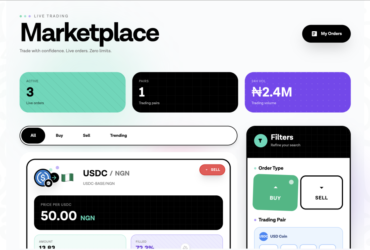

Furthermore, there are incentives for prompt payment. Banks that meet specified payment milestones will trigger the transition to End-user Billing (EUB), where customers will directly cover USSD service costs instead of banks. EUB is seen as the ultimate resolution to the payment dispute but will only be accessible to compliant entities.

Leave a Reply