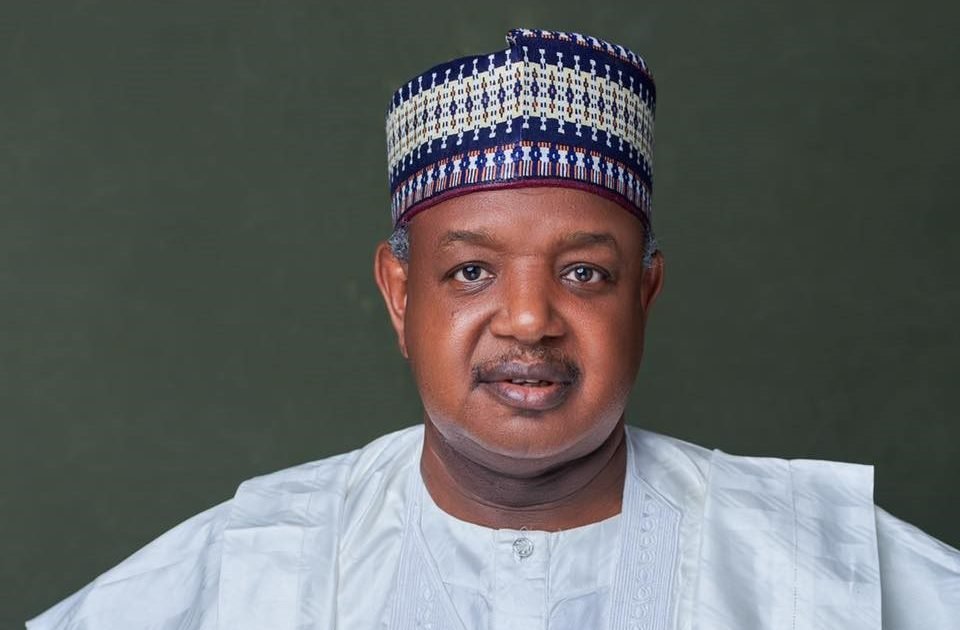

The Federal Government’s budget deficit has grown to 7.5% of the country’s Gross Domestic Product by August 2024, indicating a significant disparity between government revenue and spending. This information was disclosed by Muhammad Abdullahi, a member of the Central Bank of Nigeria Monetary Policy Committee, in a personal statement during the 297th MPC meeting. The CBN’s economic report highlighted Nigeria’s fiscal deficit rising to N4.53tn in the second quarter of 2024, up from N3.88tn in the previous quarter.

A fiscal deficit occurs when a government’s expenses surpass its income from taxes and other sources, indicating that the government is spending more than it is earning. To bridge this gap, the government often resorts to borrowing, which can elevate public debt levels. Abdullahi emphasized the challenges the government faces in boosting revenue generation while acknowledging the increased reliance on borrowing to fund escalating expenses.

The widening fiscal deficit poses concerns about long-term fiscal sustainability and its impact on national debt levels. Emphasizing the need for proactive measures to mitigate the consequences of the deficit, Abdullahi stressed the importance of monitoring the situation, especially with the implementation of the new minimum wage.

Efforts to enhance revenue generation and curtail government spending are expected to help narrow the fiscal deficit, leading to positive implications for macroeconomic stability. Aloysius Ordu, a member of the CBN Monetary Policy Committee, highlighted challenges in fiscal policy that contradict the CBN’s anti-inflationary stance, pointing out underperformance in revenue targets and the need to prioritize capital projects over recurrent spending.

Emem Usoro, Deputy Governor for Operations at the Central Bank of Nigeria, highlighted pressure points for price stability, including the widening fiscal deficit, exchange rate fluctuations, and supply chain disruptions. Lamido Yuguda, a member of the CBN Monetary Policy Committee, underscored the daunting task of revenue generation for the Federal Government, citing a significant revenue shortfall compared to targets.

The CBN’s economic report indicated a substantial rise in the deficit in the first half of the year, with the federal government’s revenue remittance marginally increasing to N2.3tn, falling short of targets. Despite foreign exchange revenue gains from naira devaluation, overall expenditure surged to N6.83tn, primarily driven by high-interest loan payments. Recurrent expenditures dominated spending, with capital and transfer payments representing a minor portion of the government’s expenses.

Leave a Reply