This is a developing story.

Update: A previous version of this story stated that CBEX might have swept away over ₦1 trillion. While anecdotal claims online have suggested this figure, TechCabal has verified losses totalling hundreds of thousands of dollars across multiple victims. We have updated the story to reflect only verifiable losses and will continue to track and report additional findings as this story develops.

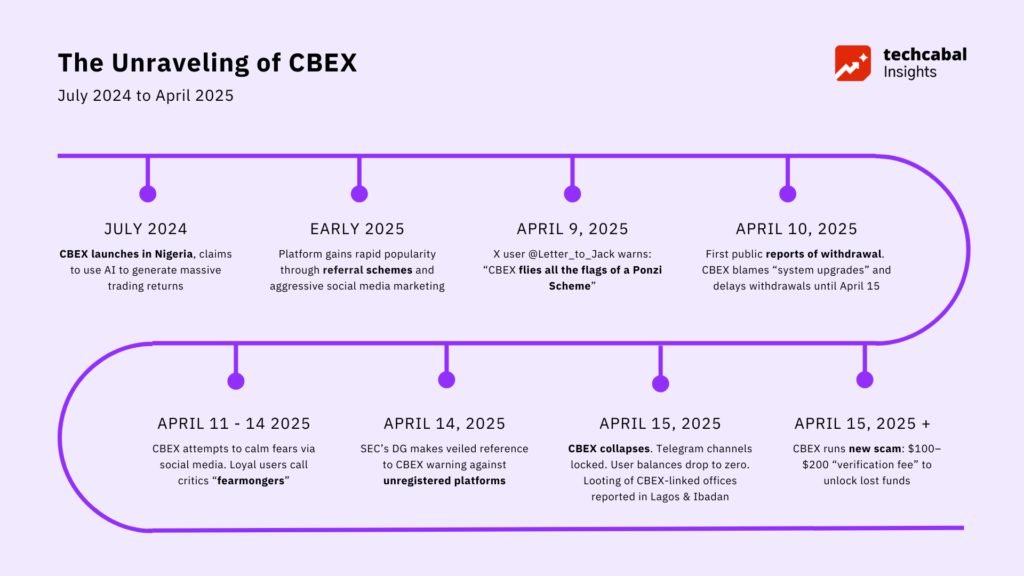

In April 2025, CBEX, a digital asset trading platform, collapsed, leaving thousands of Nigerians unable to access their funds. The platform had promised investors a 100% return on investment within 30 days, a textbook red flag for Ponzi schemes.

In one of the Telegram groups TechCabal had access to, one of the admins claimed they lost $81,430 to the scam. During an X Space hosted by Trending X, cryptocurrency expert Taiwo Owolabi revealed that the USDT address ‘TDqSquXBgUCLYvYC4XZgrprLK589dkhSCf’ was linked to the CBEX platform. Upon verification by TechCabal, it was found that the address held over $773,505,567 USDT at 13:02 WAT. We could not independently verify whether the wallet is connected to CBEX. While claims put the estimates at billions of naira in losses, TechCabal has confirmed losses in hundreds of thousands of dollars from victims, with ongoing efforts to trace more transactions. We’re also speaking to victims to learn how it unravelled.

How CBEX worked

CBEX sustained its illusion of profitability by using funds from new investors to pay earlier ones. To accelerate growth, it aggressively incentivised its users to refer others, offering tiered bonuses and rewards based on the size of their referral network. Some users reported being required to recruit at least 12 people before being allowed to withdraw profits.

CBEX, which stands for China Beijing Equity Exchange, was a digital asset trading platform that gained prominence in Nigeria in 2024. Despite its name suggesting ties to a legitimate Chinese entity, the platform had no connection to the actual China Beijing Equity Exchange and began operations in Nigeria only recently, contradicting its claims of existence since 2017.

The platform claimed to use artificial intelligence for trading, but experts and victims revealed that the trading activity and profits displayed were fake. Users faced a 40–45 day lock-in period before withdrawals, with penalties for early withdrawal. In April 2025, withdrawals were suspended entirely, and many users saw their account balances drop to zero.

Like most Ponzi schemes, CBEX enticed users with high returns, engineered proof of physical offices, and local officers who claimed they worked with the company’s head office in China, only that this was false, and this was a shell venture with no real backing whatsoever.

After the crash, CBEX offered a supposed “lifeline”—users could pay $100 or $200 in verification fees to unlock $1,000 or $2,000, respectively, a tactic to extract even more money from desperate victims.

How CBEX unravelled

CBEX began operations in Nigeria in July 2024. By April 10, 2025, reports of withdrawal issues surfaced. By April 15, the platform’s collapse became widely acknowledged. Social media was flooded with complaints, and videos showed angry investors ransacking CBEX offices in Ibadan and Lagos. CBEX locked its Telegram channels and attempted to reassure users on social media, but most experts and regulators confirmed the platform had collapsed.

The collapse triggered intense emotional responses across Nigeria. Videos surfaced online showing angry youths looting buildings believed to be linked to CBEX in protest over their lost money. In Ibadan, one CBEX office was reportedly ransacked by furious investors. Social media became a battleground of accusations, with some users expressing “zero remorse” for victims, arguing that warnings had been ignored due to greed. In contrast, others pointed to economic desperation as the driving factor behind participation.

In a virtual session on April 14, 2025, with fintech stakeholders, Nigeria’s Securities and Exchange Commission (SEC) issued a firm warning to Nigerians regarding Ponzi schemes, without explicitly naming CBEX.

SEC Director General Emomotimi Agama warned that, “Recently, a particular platform has gained attention online, with numerous posts going viral regarding its activities. Subsequently, there have been reports suggesting its shutdown. I want to make this absolutely clear—if a platform is not registered with the SEC, it is illegal.”

This announcement came as part of a virtual session with fintech stakeholders centred around the recently enacted Investment and Securities Act (ISA) 2025, which grants the SEC oversight to combat Ponzi schemes. Under the new legislation, operators and promoters of Ponzi schemes face severe penalties, including up to 10 years imprisonment and a ₦40 million fine. Agama also issued a specific warning to celebrities and social media influencers who lend their platforms to questionable ventures, emphasising their responsibility to ensure what they promote is legitimate.

The CBEX scandal represents the latest chapter in Nigeria’s long and painful history with Ponzi schemes. From early “wonder banks” in the 1980s and 1990s like Umana-Umana, Planwell, and Nospecto, to the devastating MMM collapse of 2016-2017 that affected over three million Nigerians, these fraudulent schemes have consistently exploited economic vulnerabilities.

By 2022, the Nigeria Deposit Insurance Corporation (NDIC) estimated that Nigerians lost ₦911.45 billion to Ponzi schemes over 23 years, with ₦300 billion lost in just the five years following MMM’s collapse. Other notable schemes defrauded Nigerians include Twinkas, Ultimate Cycler, Get Help Worldwide, Loom, Racksterli, and MBA Forex, which swindled investors of ₦213 billion between 2018 and 2021.

While the new Investment and Securities Act (2025) represents a significant step forward in regulatory capability, breaking the cycle of Ponzi schemes in Nigeria will require a multi-faceted approach, including stronger financial education, more accessible legitimate investment opportunities, and continued regulatory vigilance.

As the full impact of CBEX’s collapse continues to unfold, it serves as a painful reminder of the adage that has proven true in financial markets: if something seems too good to be true, it almost certainly is.

Leave a Reply