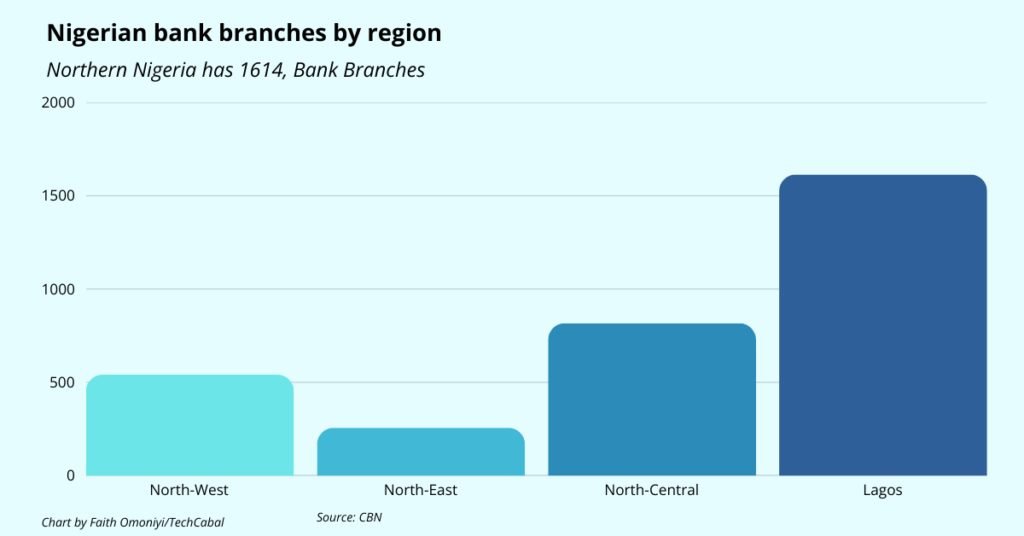

In the recent fintech boom in Nigeria between 2020-2023, the concept of “banking the unbanked” gained popularity among various fintech companies. Many of these companies aimed to provide financial services to a significant portion of Nigeria’s adult population who lacked access to banking services. However, only a handful of fintech firms were able to fulfill this promise outside of Lagos, the economic hub of Nigeria.

Fintava Pay, founded by Tobi Arowolo, Samuel Ojerinde, and Isaiah Tokunbo in 2022, introduced a Banking-as-a-Service platform to facilitate the launch of custom financial products geared towards enhancing financial inclusion in Northern Nigeria. Unlike traditional fintechs, Fintava Pay offers white-label banking solutions to businesses, super agents, and microfinance institutions, enabling them to deliver tailored financial services to their communities.

The company’s approach is particularly beneficial in Northern Nigeria, where digital literacy is low, and financial exclusion is prevalent. A significant percentage of the population in the North East and North West regions are excluded from formal financial services, relying on super agents for cash transactions. Fintava Pay’s white-label solutions empower super agents to open bank accounts for users, bridging the gap in financial services accessibility.

To address the challenges of low digital literacy and religious beliefs against interest-based banking in Northern Nigeria, Fintava Pay customizes its banking solutions in the local language, Hausa, and implements transaction verification methods that do not depend on smartphones. The company adheres to the Central Bank of Nigeria’s regulations by using BVN and NIN for account opening, ensuring secure and reliable services for users.

In efforts to combat fraud and ensure data security, Fintava Pay employs stringent identity verification processes, including OTPs sent to multiple family members for authentication. The company also distributes ATM cards for cash withdrawals to users without smartphones, enhancing accessibility to financial services in underserved areas.

By partnering with super agent networks like BusyPay, Fintava Pay has successfully onboarded thousands of customers previously excluded from digital banking services. The company’s model has garnered interest from other African markets, with plans to expand its operations beyond Nigeria.

Fintava Pay sustains its revenue through service fees, subscription plans, and transaction charges. Businesses utilizing its API infrastructure pay for accessing financial services without requiring a banking license. The company also earns from wallet top-ups, bank transfers, bill payments, ATM withdrawals, and debit card issuance linked to its platform.

In comparison to other Banking-as-a-Service providers, Fintava Pay distinguishes itself by prioritizing financial inclusion in underserved regions and tailoring solutions to local financial behaviors. The company’s strategic focus on partnering with existing microfinance banks and agent networks sets it apart from competitors, providing deep customization options for businesses to operate their fintech solutions.

Fintava Pay’s commitment to addressing financial inclusion challenges in Africa positions it as a potential pan-African provider of Banking-as-a-Service, with plans for expansion and fundraising in the future.

Leave a Reply