A major Nigerian commercial bank recently increased staff salaries by 40% in response to the rising cost of living. Several employees shared that the raise came as a surprise without prior notice. An assistant banking officer disclosed receiving a new salary of ₦720,000 ($442) after the adjustment.

Known for its low cost-to-income ratio, the bank spent ₦0.29 to make ₦1 in 2023, maintaining its position as one of Nigeria’s most profitable Tier-1 banks. Despite the significant raise, the bank’s financial reports indicate that it will spend ₦0.30 to make ₦1 based on the previous year’s figures.

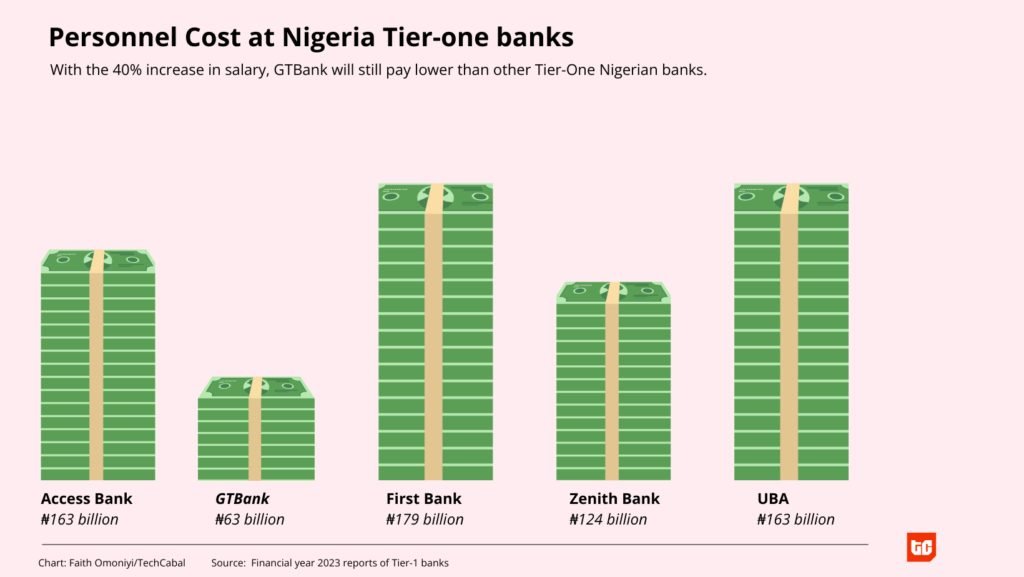

In 2023, the bank allocated ₦45.1 billion ($27.7 million) for salaries, considerably less than other Tier-1 banks. Even with the salary increase totaling ₦63.1 billion ($38.7 million), GTBank still maintains the lowest salary bill among its Tier-1 counterparts based on financial records.

The economic reforms implemented, including currency devaluations and fuel subsidy removal, have led to a devaluation of the naira by nearly 70% against the dollar and a 30% increase in inflation, impacting Nigerians significantly.

The salary adjustment could have been a strategic move to retain employees amidst the challenging economic climate. Previously, the bank doubled salaries for its technology team to prevent staff migration to other institutions. Employees in the technology division reportedly earn more than their counterparts in other departments.

All 3,300 GTBank employees benefited from the recent salary increase, deviating from the common practice of only extending such benefits to head office staff. This marks the first salary adjustment in 2024 and the second in two years for GTBank employees.

*Exchange rate used: $1 = ₦1630

Editors note: An earlier version of this article misstated GT’s cost-to-income ratio. We have updated the article to reflect the accurate information.

Leave a Reply