Pokkit Score (Pokkit), a startup founded in 2023 in South Africa, offers a fresh approach to improving credit scores without relying on borrowing money. This alternative method aims to tackle the prevalent financial inclusion challenges faced in a society marked by income inequality and limited credit accessibility.

Traditionally, building a good credit score in South Africa has been tied to taking on debt, often burdened with high interest rates. However, this approach excludes many low-income individuals in a country where a significant portion of the population lives below the upper-middle-income poverty line.

Despite the dominance of five major banks in South Africa’s banking sector, a large portion of the population lacks adequate credit access, with millions having no credit score at all. This lack of credit history hinders access to essential loans for housing, vehicles, and education.

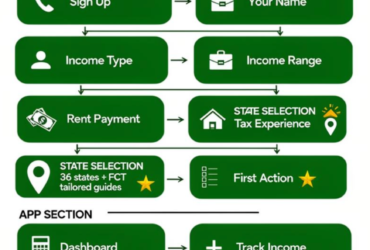

Pokkit enables individuals to enhance their credit scores by utilizing their savings rather than accumulating debt. Customers can purchase savings vouchers that are invested securely, with returns shared with customers. By observing savings behavior, Pokkit helps customers establish or enhance their credit scores.

Pokkit’s CEO, Johan Koornhof, emphasizes the importance of using savings as a pathway to credit, promoting financial discipline and avoiding the pitfalls associated with high-interest debt. The platform also offers low monthly fees and a money-back guarantee if there is no improvement in credit scores within a year.

Pokkit’s success is measured by the tangible financial empowerment experienced by its users. The platform has demonstrated significant results, with a high percentage of customers obtaining credit scores within a few months and seeing improvements in their scores through regular payments.

Looking ahead, Pokkit aims to expand its services beyond South Africa to address similar financial inclusion gaps prevalent across the African continent. Overcoming challenges related to trust and accessibility, the company focuses on secure data handling and efficient payment management to ensure customer satisfaction.

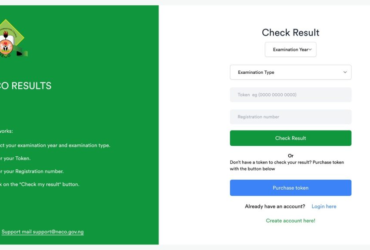

Technology plays a vital role in Pokkit’s operations, with a sophisticated online system supported by secure data storage and compliance with relevant data protection laws. The company envisions becoming a leading data aggregator, providing comprehensive credit reporting services and incorporating alternative data sources to enhance credit assessment accuracy.

Leave a Reply