Prediction

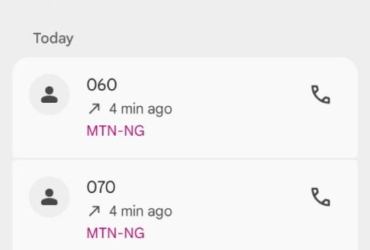

Cybersecurity will emerge as a standalone investment category in African tech. The trigger is not compliance or maturity; it is threat escalation. As AI tools become accessible, bad actors are deploying LLM-generated phishing that mimics local communication styles, deepfake voice attacks targeting phone-based banking, and social engineering campaigns customised to African languages and contexts. For example, the same mobile money infrastructure that processes over $1.1 trillion annually is now a prime target. Fintechs that raised Series A and beyond will move security from afterthought to board-level priority, and we will see at least one dedicated cybersecurity startup raise a significant round as enterprises scramble to catch up.

Supporting Evidence

Africa’s digital rails were built fast; 60% of venture capital flowed to fintech, yet the corresponding security infrastructure barely exists. There is no shortage of demand; there is a shortage of Africa-specific solutions. Most threat detection models are not trained on African datasets, few tools account for low-bandwidth environments, and the talent pool remains thin. AI changes both sides of this equation: it lowers the cost of sophisticated attacks while enabling defenders to automate what they cannot staff. The gap between the value stored on African digital platforms and the security protecting it is widening, and that gap is where capital will move.

Risk Factor

Visibility. Cybersecurity breaches in Africa are chronically underreported, companies fear reputational damage, regulators lack enforcement capacity, and the true scale of losses stays hidden. If major incidents remain invisible, enterprise urgency will lag behind actual risk, and the category will stay underfunded despite the fundamentals.

Who is Uwem Uwemakpan?

Uwem Uwemakpan is Head of Investment at Launch Africa Ventures, where he leads early-stage investing across the continent. He has supported investments across 30+ African startups and works closely with founders on fundraising strategy and positioning for follow-on rounds with global investors.

He also hosts The Grinders Table podcast, where he profiles African founders, investors, and business leaders, focusing on the decisions, setbacks, and unconventional thinking behind company-building—rather than polished success narratives.

Before Launch Africa Ventures, Uwemakpan was Vice President, Fund Operations at Ingressive Capital, and previously worked with the Tony Elumelu Foundation, supporting the scale-up of its $100 million entrepreneurship programme.

Leave a Reply