This is Follow the Money, our weekly series that unpacks the earnings, business, and scaling strategies of African fintechs and financial institutions. A new edition drops every Monday.

Whether it is football, prayer meetings, or Nollywood marathons, life in Nigeria now runs on data. That shift, plus a long-overdue tariff hike, has increased the country’s monthly data bill by 307.74% to ₦721.18 billion in July 2025 from ₦176.87 billion in July 2023.

For Peter Adebiyi, a fashion entrepreneur, data has replaced cable. His 40-inch TV has never seen a satellite dish. “I use a smart TV, so I just stream whatever I want to watch,” he told TechCabal.

That shift has driven an 83% surge in data consumption in just two years, boosting telecom revenues but leaving Nigerians to shoulder a far steeper monthly bill.

According to the Nigerian Communications Commission (NCC), one hour of video streaming consumes about 350 MB in standard definition and 1 GB in high definition. More streaming has meant more data usage. Monthly consumption has surged 83.88% to 1,131,255.90 terabytes (1.13 billion GB) in July 2025, up from 615,207.39 TB (615.21 million GB) in July 2023.

The math

By TechCabal’s calculations, Nigeria’s monthly internet spend rose to ₦721.18 billion in July 2025, based on an average cost of ₦637.5 per GB. Two years earlier, it stood at ₦176.87 billion when 1 GB averaged ₦287.5.

This calculation was based on findings that revealed the average cost of 1GB in the country (using prices on the telcos’ websites). 1GB on Airtel was ₦350, ₦200 on MTN, ₦300 on Glo, and ₦300 on 9mobile, bringing the average cost of 1GB to ₦287.5 in 2023.

In July 2025, 1GB on Airtel was ₦800, ₦500 on MTN, ₦750 on Glo (for 1.1GB), and ₦500 on 9mobile, bringing the average cost of 1GB to ₦637.5 in 2025.

Average monthly data consumption per subscriber has risen to 8.15 GB in July 2025 (with 138.75m subscriptions), from 3.86 GB in July 2023 (with 159.54m internet subscriptions).

Win for telcos

MTN’s data revenue has risen by 379.63% since 2020 to ₦1.59 trillion in 2024, and stood at ₦1.23 trillion in the first half of 2025.

Airtel’s data revenues are up 50.35% since 2020, hitting $654 million as of its fiscal year ended March 2024. Airtel’s average data usage per customer has jumped 232.14% since March 2021, hitting 9.3 GB in June 2025, while MTN’s rose by 53.49% since December 2023 to 13.2 GB per customer in June 2025.

This surge has pushed Nigeria above the regional average for internet usage, with around 29% of the population using it 85% of Nigerians on the mobile internet use it to make or receive video calls, 75% use it to watch free-to-access online videos, and 54% use it to stream free music, according to GSMA.

YouTube takes the screen

YouTube has been one of the biggest winners. Aside from being the primary streaming platform of choice for many religious leaders, it has become a home for Nollywood movies.

Watch time in Nigeria grew more than 55% year-on-year as of October 2024, with more than 2 million Nigerians now watching YouTube on connected TVs at home, the company disclosed at its TV/Film Day in Lagos in August.

The number of Nigerian channels making eight figures in revenue grew by 100% in 2024.

“As filmmakers, the screen no longer means only the cinema or television set,” said Nollywood producer Bolaji Ogunmola at YouTube’s event. “For many Nigerians, YouTube is the new TV.”

Tarek Amin, director for YouTube in the Middle East, Africa, and Turkey, added, “The old gates are coming down. We are in the midst of an ever-evolving media landscape, and Nigerian creators are at the heart of it.”

Drawbacks

As the internet becomes more central to everyday life, costs are also biting harder. In January, telcos implemented a 50% tariff hike after a decade of price stability, citing rising operational costs.

Adebiyi told TechCabal that his monthly data bill has tripled since January from about ₦10,000 to close to ₦30,000. Temiloluwa Toluwase, a digital marketer, now spends no less than ₦20,000 monthly from ₦10,000.

Adeolu Ogunbanjo, president of the National Association of Telecoms Subscribers (NATCOMS), said the hike has imposed untold hardship on many Nigerians. “Some people were forced to cut back on use.”

Affordability and digital literacy remain the biggest barriers to broader adoption, GSMA noted. Internet subscriptions have already fallen by 3.41 million since January, dropping to 138.75 million by July 2025.

Complaints about data depletion have also risen, with many subscribers accusing telcos of overbilling. According to the NCC, much of this usage is down to background app updates and heavy screen time.

“It is important that telecom subscribers are equipped with the knowledge of how to monitor, control, and optimise the usage of their mobile data bundle allowance, be it daily, weekly, or monthly plans,” Freda Bruce-Bennett, director of Consumer Affairs Bureau at the NCC, said during a media briefing in August.

Even with rising consumption, broadband penetration — availability of high-speed internet access — remains below 50%. The International Telecommunication Union (ITU) estimates that only 38% of Nigerians (and Africans) used the internet in 2024, far below the global average of 68%. About 20 million Nigerians remain completely unconnected, according to Bosun Tijani, Minister of Communications, Innovation, and Digital Economy.

Lack of internet usage cuts many from digital technologies, which are crucial for economic growth, innovation, job creation, and inclusion, according to Andrew Dabalen, World Bank Chief Economist for Africa.

To close some of these gaps, Nigeria is rolling out 90,000 km more of fibre optic cables at $2billion.

Despite these challenges, internet usage is expected to grow in the country, with 32 million new unique mobile internet subscribers expected in the country between 2025 and 2030.

Karl Toriola, the CEO of MTN Nigeria, captured this in a TV interview in January 2025: “We are positioning ourselves to capture the opportunities of growth for the next 10 years. The demand for data in Nigeria is exceptional and will continue to grow.”

While data is now central to how Nigerians pray, learn, work, and play, soaring costs and infrastructure hiccups could continue to leave many on the sidelines of the country’s digital future.

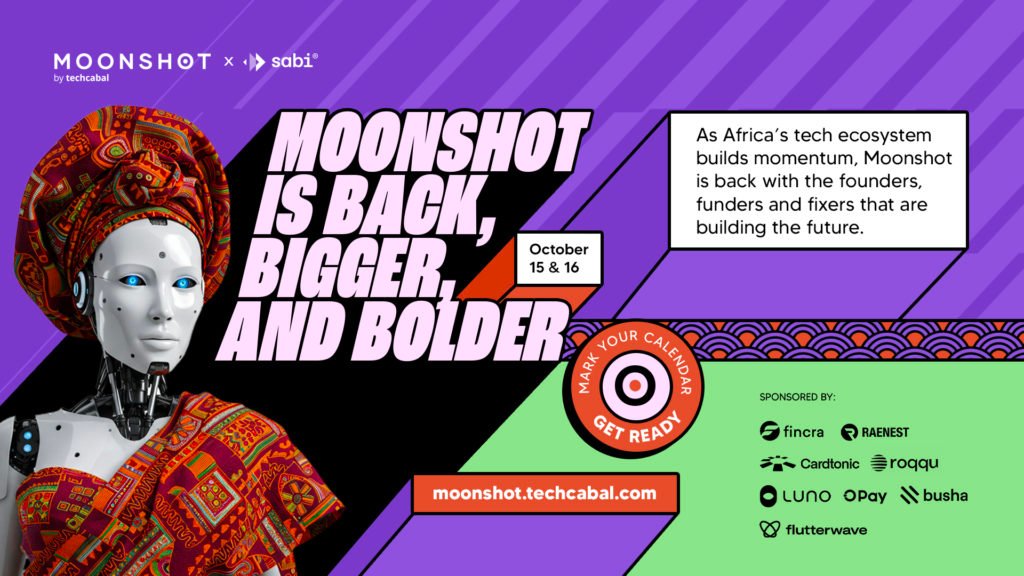

Mark your calendars! Moonshot by TechCabal is back in Lagos on October 15–16! Join Africa’s top founders, creatives & tech leaders for 2 days of keynotes, mixers & future-forward ideas. Early bird tickets now 20% off—don’t snooze! moonshot.techcabal.com

Leave a Reply