First published 15 September, 2024

What’s the future of Kenyan fintechs?

M-Pesa, Kenya’s prominent mobile payment platform, handled a significant 20 billion transactions in 2023, representing about 60% of the country’s GDP.

Despite the remarkable impact of M-Pesa on digital banking and payment services in Kenya, the market dominance of this platform has somewhat hindered the growth of fintech startups. Unlike its counterparts in countries like Nigeria, Egypt, and South Africa, Kenyan fintechs have not been able to establish new digital payment standards. Some attribute this lag to the regulatory environment in the country, but the undeniable success of M-Pesa remains a prominent factor.

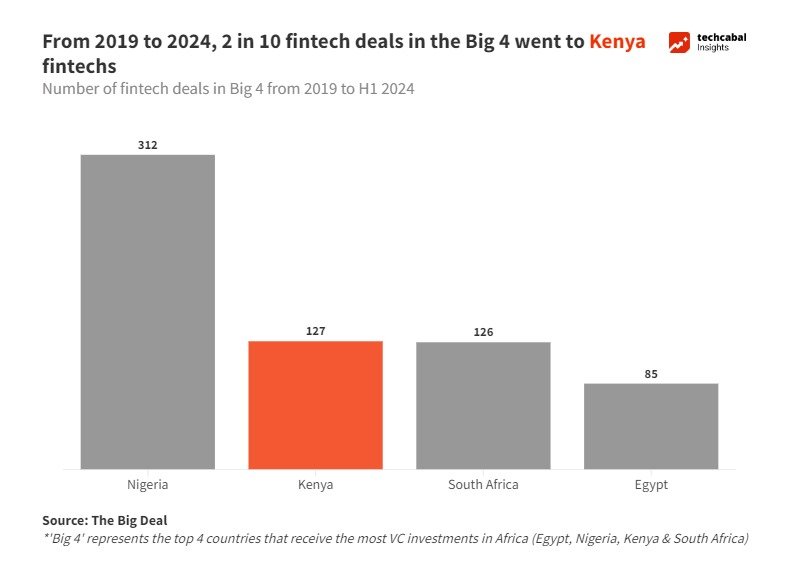

Looking ahead, a report by a market intelligence firm revealed that Kenyan fintechs secured 8% of total investments in the sector between 2019 and 2023, trailing behind countries like Nigeria, South Africa, and Egypt.

Next Wave continues after this ad.

With a shift towards climate tech attracting a significant portion of total deals in the first half of 2024, the prospect of building a digital bank to challenge traditional providers may face challenges. M-Pesa has facilitated access to financial services for the unbanked population, while traditional banks have responded by introducing digital banking platforms, addressing issues of accessibility and convenience.

For founders seeking investment, showcasing a viable business model that demonstrates profitability and customer acquisition is crucial. Merely having smartphone-friendly technology is not adequate to compete with established Kenyan traditional banks and telecommunication companies, which have shown their ability to incorporate features used by neobanks to capture market share. Traditional financial institutions have also displayed their capability to invest heavily and recruit talent from fintech companies, implementing innovative ideas.

Fintech deals in Kenya

Leave a Reply