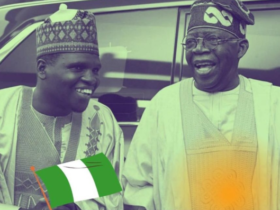

The importance of fiscal transparency in enhancing Nigeria’s credit profile, attracting investors, and reducing borrowing costs was underscored by the Minister of Finance and Coordinating Minister of the Economy during a recent meeting with the First Deputy Managing Director of the International Monetary Fund. Key economic reforms aimed at fostering financial stability and investor confidence were discussed during the meeting, with a focus on enhancing fiscal data transparency to strengthen Nigeria’s credit profile. The government’s efforts to improve fiscal discipline, transparency in public finance management, and revenue mobilization were highlighted as part of ongoing reforms to make Nigeria more appealing for investment.

Updates on social investment programs transitioning to a more efficient and accountable system were shared, aligning with broader governance and financial prudence initiatives. The Minister also touched on Nigeria’s increased crude oil production contributing to revenue growth and government financial stability. Policy shifts to boost renewable energy adoption, improve investment conditions, and expand service exports were outlined as part of efforts to drive economic development through private sector investment.

Advocacy for expanded metering systems in the electricity sector to enhance efficiency and encourage private sector participation in power distribution was emphasized. Nigeria’s commitment to securing fairer credit ratings for African economies through improved fiscal transparency and governance was reiterated to position the country for enhanced credit assessments by global rating agencies. The meeting concluded with positive feedback from the International Monetary Fund representative on discussions regarding Nigeria’s economic outlook and strategies to address the high cost of living, emphasizing the acceleration of social support initiatives.

Leave a Reply