Despite efforts by the Central Bank of Nigeria, the foreign exchange market in Nigeria is still facing challenges according to Fitch Ratings, a global rating agency. This contrasts slightly with the International Monetary Fund’s view that the naira is stabilizing due to recent interest rate hikes and CBN actions to address FX obligations.

The IMF’s Global Financial Stability Report acknowledged Nigeria’s policy actions and credited CBN’s efforts in clearing overdue FX commitments as positive steps towards naira stabilization. However, Fitch Ratings remains cautious, stating that the FX market has yet to stabilize despite CBN’s initiatives.

Fitch also highlighted an increase in Nigeria’s gross FX reserves, attributing the rise to official disbursements, remittances, and an improved trade balance. The agency expressed concerns about the composition of net reserves, noting a significant portion comprised of FX swaps with local banks.

CBN Governor Olayemi Cardoso mentioned that confidence in the naira is gradually returning due to orthodox monetary policies aimed at ensuring stability. He emphasized the importance of transparency and efforts to sanction those taking advantage of the market.

Despite some positive movements in the exchange rate, challenges persist, with the naira trading above N1,600. The Purchasing Managers’ Index report by Stanbic IBTC Bank Nigeria highlighted increasing challenges in the private sector due to the weakening naira driving up purchase costs.

The report noted a decline in business conditions attributed to currency depreciation impacting input costs and leading to price hikes for goods and services. The private sector faces inflationary pressures, rising operational costs, and shrinking demand, affecting business activity and job creation.

The Head of Equity Research for West Africa at Stanbic IBTC Bank, Muyiwa Oni, emphasized that inflation and currency-related pressures are compounding Nigeria’s economic strain. He mentioned that ongoing exchange rate challenges and high interest rates could dampen non-oil sector growth.

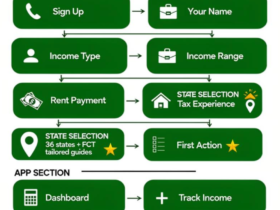

As Nigeria navigates these economic challenges, the CBN is set to introduce an Electronic Foreign Exchange Matching System to enhance transparency and promote a market-driven exchange rate accessible to the public. Scheduled for implementation in December 2024, the new system aims to transform Nigeria’s foreign exchange market.

Leave a Reply