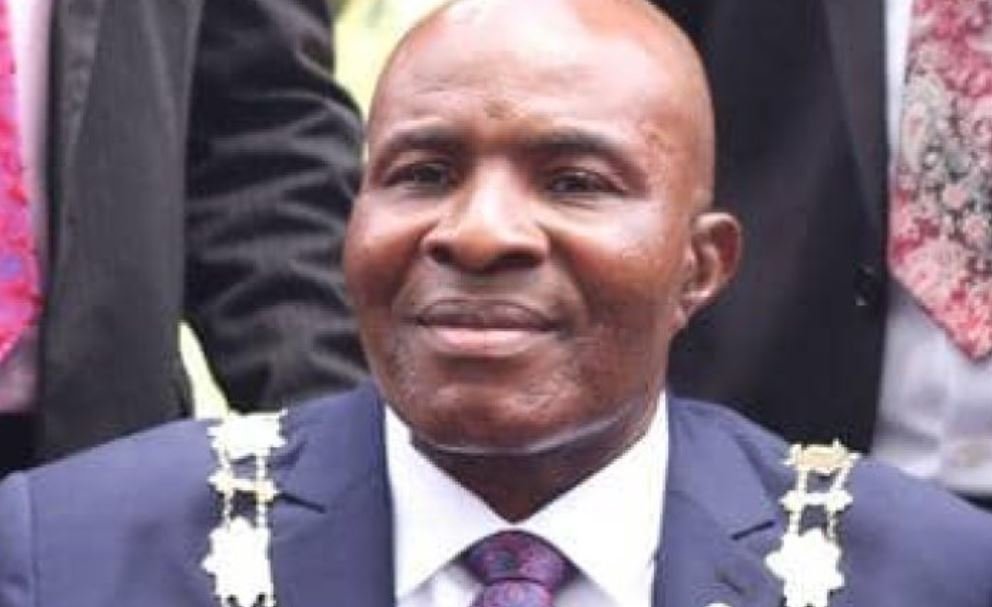

The head of a prominent accounting organization discusses utilizing the legal system to combat corruption and other related matters.

Is the management of public finance and the yearly budget compliant with legal requirements, particularly concerning financial practices?

The challenge lies not in the formulation of policies or regulations but in their enforcement. Nigeria has established rules and policies delineated in the constitution for the functioning of different levels of government. The constitution specifies the distribution of funds among various government tiers, such as what should be allocated to the federation account, states, and local governments.

Although the regulations are in place, the issue often arises in their implementation. Instances occur where government officials obstruct the proper execution of mandated tasks. Auditor generals have been dismissed for advising against certain actions. However, societal support for such officials is lacking.

There is a call to adhere to existing regulations. Nigeria boasts a significant number of accounting professionals globally, yet the challenge remains in enforcing financial regulations and public service rules.

Numerous individuals enter public service with noble intentions but veer off course once in office. Corruption is not exclusive to Nigeria, but the extent of the malpractice sets the country apart. The regulatory framework for public finance exists, yet the issue lies in the execution and oversight of those in authoritative positions.

Efforts to combat unethical conduct among members, particularly those in public service potentially involved in corruption, are being undertaken. Can you elaborate on these measures?

The accounting institute has established a disciplinary system and an investigative panel, divided into six units due to increased membership. Individuals can report ethical breaches by ICAN members through a formal process involving legal affirmation.

Investigations are conducted impartially, allowing both the accuser and the accused to present their cases with legal representation. The institute ensures fair treatment and upholds constitutional principles during the disciplinary process.

Instances of misconduct are addressed promptly, with past cases resulting in sanctions even against high-ranking officials like past presidents and government accountants.

The prevalence of fraud extends beyond ICAN members to various sectors of society. Addressing corruption requires a shift in societal values towards integrity and transparency.

What strategies can Nigeria employ to tackle the widespread corruption it faces?

Reforming the judicial system to expedite fraud trials and imposing stricter penalties on offenders could deter corrupt practices. Specialized courts dedicated to fraud cases could ensure swift justice, deterring individuals from engaging in corrupt activities.

Swift and decisive legal action against corrupt individuals, possibly including severe penalties like life imprisonment or the death penalty, could serve as a deterrent. Cases of corruption in Nigeria often drag on for years, undermining public trust in the legal system.

Establishing specialized courts for fraud cases with expedited proceedings could lead to more effective deterrence against corruption. Preventative measures, including ethics education and societal values, are crucial in fostering a culture of integrity.

What is your stance on the various charges imposed by Nigerian banks on customers and their wealth management practices?

Banking regulations govern fees and charges, and customers should report any unjustified debits. It is essential for individuals to understand the terms and conditions of financial transactions to avoid unexpected charges.

Encouraging transparency in financial agreements and empowering customers to report discrepancies to regulatory bodies like the Central Bank and Consumer Protection Commission can help address concerns regarding bank charges.

ICAN does not oversee banking operations but can relay public complaints to regulatory authorities for resolution. Educating individuals on financial literacy and contract terms is crucial in promoting fair banking practices.

Regarding tax reform bills, what is your organization’s perspective on this matter?

ICAN has established a task force to evaluate tax reform proposals and will release a position paper on the subject shortly.

Do you believe the one-year tenure for ICAN presidents allows for significant impact

Leave a Reply