The Securities and Exchange Commission (SEC) of Nigeria is planning to expedite the issuance of crypto licenses in 2025 to regulate the cryptocurrency market and safeguard consumers. This initiative aims to provide clear regulations in a market that currently lacks significant oversight.

Through the Accelerated Regulatory Incubation Programme (ARIP) launched in June 2024, the SEC has already granted provisional licenses to two Nigerian crypto startups. The regulator has expressed its intention to speed up the approval process for more licenses in the coming year.

Nigeria is recognized as an active crypto market, with individuals and businesses utilizing cryptocurrencies and stablecoins to protect against inflation and exchange rate fluctuations. However, the absence of a well-defined regulatory framework poses considerable uncertainties for users and investors.

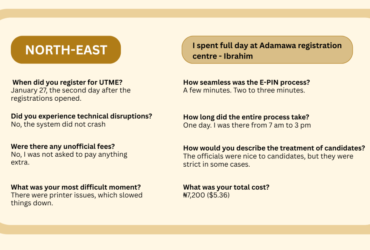

Security concerns have been highlighted as a key obstacle to crypto adoption in Nigeria, with nearly half of surveyed individuals expressing apprehensions. Risks associated with centralized exchanges, peer-to-peer transfers, and scams like rug-pulls have been identified as significant challenges in the crypto space.

Crypto platforms are focusing on user education to mitigate these risks, but regulatory bodies are seen as crucial in ensuring consumer protection. The SEC’s efforts to regulate digital assets began in 2020, and the establishment of the ARIP in 2024 marked a significant shift from the country’s previous anti-crypto stance.

As the SEC progresses towards full regulation of the crypto market, there is optimism that clearer guidelines will enhance confidence among institutional investors and banks. A transparent regulatory environment could also facilitate the taxation of crypto transactions, a concept Nigeria has been exploring since 2022.

While the SEC’s steps towards regulating crypto are commendable, finding the right balance between innovation and compliance remains a key challenge. Over-regulation could impede sector growth, driving businesses to more favorable jurisdictions. The SEC aims to strike a balance that fosters growth while safeguarding consumers, but the exact approach to achieving this equilibrium is yet to be fully determined.

Leave a Reply