In Johannesburg’s inner city, street traders turn sidewalks into shopfronts. On one side, a woman chops inhloko (cow head), her knife striking with the rhythm of long practice. Down the way, a man is bundling fresh spinach into tight green bouquets, while a young man pushes a trolley of boxed mixed vegetables wobbling with each bump in the road. Beyond food and vegetables, second-hand clothes spill out of bales, and on the corner, pop-up salons braid hair in the open air. Money moves fast here. Folded notes disappear into aprons, and coins clink into plastic tubs, a soundtrack to the hustle.

This is South Africa’s informal economy, and Gauteng claims about 29% of it, with most activities happening in Johannesburg’s inner city. It is a powerful engine of trade and creativity, employing nearly 20% of the country’s workforce, according to Stats SA.

While there has been a wave of fintechs and other platforms to address payments in the informal trader space, street vendors shun away from digital payments such as eWallets, EFTs, because of scam issues, the time to process transactions and to get the money, and affordability issues.

Despite a wave of fintechs pushing digital tools for small businesses, most traders here remain fiercely cash-first.

Thulisile Gumede, who has been selling vegetables in the same spot for five years, shakes her head as she folds her day’s earnings into a cloth purse.

“In the streets here, we want cash,” she says. “The way scammers are so many these days, I don’t think eWallets or others can be trusted. Someone will send you money, then withdraw it again, or send you a redeemed voucher already.”

Given Zulu, another trader nearby, who sells fruits, echoes similar frustration. “As much as we need other payment methods, they come with costs,” he adds. “And the money does not come straight away, I have to go to the bank. With cash, I can go buy stock immediately.”

For many street vendors, digital payments carry more hassle than convenience: navigating multiple banks to withdraw eWallet transfers, paying transaction fees that eat into already-thin margins, and dealing with connectivity blackspots where payments simply will not go through. Vendors spoke about making a daily profit of between R200 and R700. The average card transaction fee can be between 1.5%–2.75% per sale. On a day with R500 in card sales, a vendor pays R12.50–R13.75 in fees, this can account for about 8–14% excluding VAT, of their entire daily earnings.

Rinsing out the big silver pot where she had just cooked inhloko, Zodwa Ndlovu explains that “at lunchtime my queue for pap and inhloko gets very long. If I start taking card payments or waiting for people to process transfers, it will only slow me down and I will lose my daily target of R700”

Ndlovu works with an assistant, but when asked if that person could handle digital payments, she shakes her head. “Where I buy my stock, they only want cash. So there is no point in putting money in the bank, it will just come up short.”

The contrast with spaza shops is stark. They have fairly adopted POS machines, mainly Kazang and a few others using Yoco and iKhokha, allowing them to accept card payments, cash in eWallets, and even offer airtime or bill payments. The difference is that street vendors move often, sometimes in conflict with the metro police due to issues of licenses and do not always have secure storage for machines. Spaza shops process higher daily sales, making fees more tolerable and wholesalers increasingly want electronic payments, nudging spazas toward digital tools.

Street vendors, by contrast, are more vulnerable. Carrying wads of cash exposes them to theft or extortion gangs, but handing money to “the cloud” feels even riskier.

“I want people to pay in cash because I do not want the hassle of going to different banks collecting money. But truly speaking, handling cash everyday needs discipline and to be wary of criminals,” says Melody Mncube, who plaits hair by the street corner.

The cost of banking cash

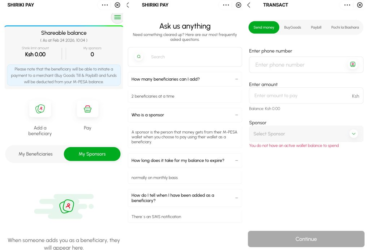

South Africa has over 140 fintech startups with a number of these currently eyeing South Africa’s informal economy, from large-scale players like MTN MoMo, Mukuru, and VodaPay, to hyperlocal startups such as Street Wallet experimenting with QR codes and WhatsApp-based payments, though not yet in Johannesburg.

Millions of traders are still unbanked or underbanked with billions in untapped transaction volume, and the chance to “formalise” one of Africa’s most visible economies. But uptake remains patchy.

“In the informal market, digital payment systems are hard to access such as affordable connectivity, and in some areas there is barely a phone signal ,” says Vusi Vokwana, the founder of Kasi Catalyst, an initiative that helps local entrepreneurs turn bold ideas into thriving businesses.

“The most glaring obstacle is the cost of banking cash. So the majority of traders only deposit the cash they need to pay the few suppliers who only accept electronic payments,” says Vokwana.

Some vendors see digital payments as simply out of reach. “I understand we are living in the digital age, but selling in the streets makes it difficult for us to work like some of these spaza shops that have card machines. With the little money I get from here, thinking of buying a card machine is another story,” says Ayo Bello who has been selling second hand clothes for over 10 years.

And yet, handling physical cash is no less risky. Gumede admits she has to discipline herself daily: “You must be strong, because carrying money makes you a target. Criminals know we leave here with cash.”

For now, fintech adoption in Johannesburg’s street economy is an uneasy standoff. Vendors see digital as costly and unreliable while fintech startups see cash as outdated and inefficient. Between them lies billions in daily trade and the daily survival of traders who must weigh speed, trust, and risk with every transaction.

What would it take to shift? Lower fees? Offline functionality? Greater trust? Or will cash remain dominant in Johannesburg’s streets for years to come?

Mark your calendars! Moonshot by TechCabal is back in Lagos on October 15–16! Join Africa’s top founders, creatives & tech leaders for 2 days of keynotes, mixers & future-forward ideas. Early bird tickets now 20% off—don’t snooze! moonshot.techcabal.com

Leave a Reply