In discussions at Moonshot by TechCabal, it was highlighted that for open banking to be fully operational in Nigeria, approval from the Central Bank of Nigeria (CBN) is crucial. The concept of open banking in Nigeria was established in 2017 with support from key industry players, but the CBN’s endorsement is still pending.

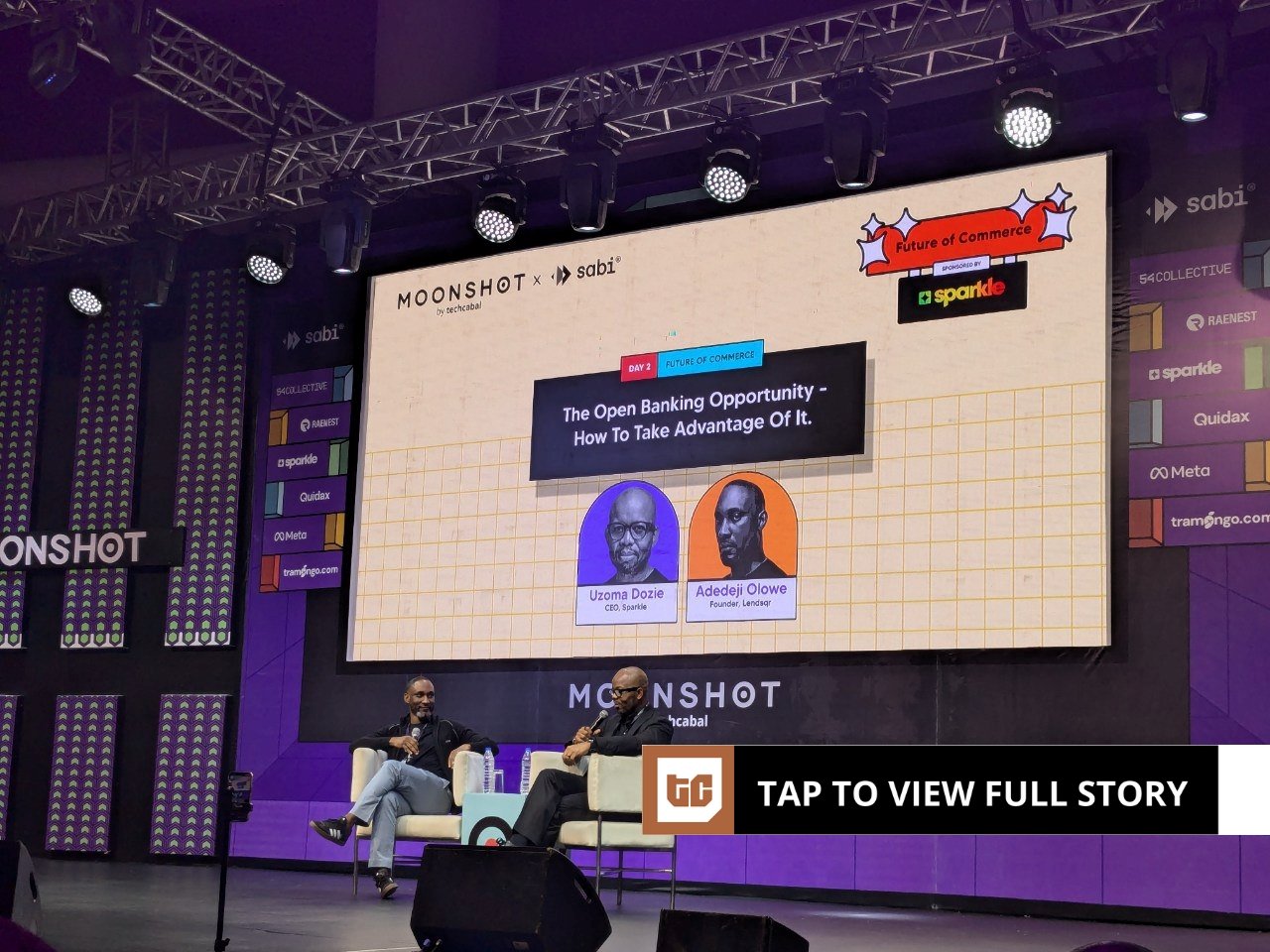

Adedeji Olowe, founder of Lendsqr, emphasized the necessity of CBN’s approval during a conversation with Uzoma Dozie, CEO of Sparkle. Despite the CBN releasing a regulatory framework draft for open banking in 2023, challenges in system development and regulatory alignment have delayed its implementation in Nigeria.

Open banking, which has gained momentum in Nigeria over the last few years, is seen as a means to provide fair competition among financial institutions. It is also aligned with the General Data Protection Regulation (GDPR) to ensure data protection and user control over personal information.

The potential benefits of open banking include the sharing of customer data between banks and third-party providers to offer innovative financial products and services. This can lead to the creation of cost-effective loans and personalized financial tools for consumers.

Lendsqr, a digital credit management startup, believes that open banking can lower credit costs by enabling lenders to access banking information efficiently. The focus on data privacy, overseen by the National Data Protection Commission (NDPC), is crucial for the success of open banking initiatives in Nigeria.

The groundwork has been laid for open banking in Nigeria, awaiting the final approval from the CBN to kickstart this transformative financial approach.

Leave a Reply