OurPass once promised to be a game-changer—a one-click checkout platform that would smooth the path for online commerce. But in three years, after three pivots, the startup has left a trail of arrested staff, unpaid employees, stranded customers, and unanswered regulatory questions.

On the morning of Wednesday, June 19, 2024, OurPass’s leadership team gathered for what seemed like a routine management meeting at the Nigerian fintech. Instead, it triggered a chain of events that led to an arrest, months of unpaid salaries, and customers locked out of their deposits.

Midway through the meeting, Samuel Eze, the CEO, asked if any employee had seen a circular from the Central Bank of Nigeria (CBN) that had just landed in the company’s inbox, according to internal emails reviewed by TechCabal.

After the meeting, Hencho Nwaegu, the former head of finance, accessed the email. It looked official and contained an attachment requesting a password. Suspicious, he hesitated, but at the time, the company was awaiting its long-sought microfinance banking licence from the CBN, so the message did not seem out of place.

Nwaegu eventually opened it after the CEO had already interacted with the email without issue, according to email correspondence seen by TechCabal. After he entered his login details, his phone buzzed with an alert showing his account had been accessed from the United States. Strangely, Eze received the same foreign login alerts.

The midnight transfers

Around 1 a.m. the next day, five unauthorised transfers quickly swept through OurPass’s bank account at VFD Bank. Four went through successfully, totalling ₦25 million ($16,260).

“We faced an internal security incident that tested our governance,” an OurPass spokesperson told TechCabal. “It was contained without impact to customer deposits, and investigations with law enforcement are ongoing. We have since strengthened our access controls and oversight mechanisms.”

However, there was something strange about these transfers. Three exceeded OurPass’s single-transaction cap of ₦5 million ($3,250).

By the next morning, debit alerts had reached Eze’s phone. He began asking questions. How, he wanted to know, had Nwaegu logged into his email from the United States while physically in the office? He told Nwaegu to change his password. Nwaegu did.

But the first seeds of suspicion had already been planted.

The arrest

According to Nwaegu, when he realised the breach the next morning, he sent emails to VFD Bank and even booked a ride to the bank’s office. Wanting to conduct an internal investigation first, Eze asked him to stop contacting the bank without approval. That delay is what Nwaegu blames for the money never being recovered.

By late afternoon, Nwaegu and a colleague were finally sent to the bank. There, staff confirmed his suspicion that his and Eze’s passwords had been compromised. One week later, by 9 p.m. on Wednesday, June 26, 2024, police arrived at the OurPass office to arrest Nwaegu.

Email conversations between Nwaegu and OurPass show that no warrant was presented. He was denied contact with family or legal counsel for over 12 hours. At the Victoria Island police station, he was questioned by officers and his CEO.

“I feared for my life following the manner of arrest and detention,” Nwaegu wrote in an email seen by TechCabal.

He was accused of changing the CEO’s password because he was an administrator on the company’s email system. Nwaegu insisted he never knew he had admin access. To his knowledge, only Eze and the head of operations held such access.

When the head of operations heard of the arrest, she did not return to work the next day. On Thursday, June 27, 2024, OurPass formally suspended Nwaegu, citing “recent allegations of fraud”. Nwaegu denied the allegations.

“I am requesting the documented police report that reflects a full investigation and verification by the Force Criminal Investigation Department (FCID),” reads a mail sent by Nwaegu and seen by TechCabal. “My understanding, based on communication with the police, is that the initial investigation was inconclusive regarding my involvement and that the matter was dismissed after the complaint was withdrawn.”

Internal investigations

On October 24, 2024, over four months after the fraud occurred, OurPass sent Nwaegu the results of its internal investigation. The committee concluded he was guilty of fraudulent conduct because his email was used in the unauthorised transactions, negligence of duty because he failed to secure his password, and policy violation for refusing to hand over duties after his suspension.

OurPass did not comment on the result of its internal investigation.

A disciplinary hearing was scheduled for October 28. But Nwaegu pushed back, formally requesting intervention by the Nigerian Public Complaints Commission. He alleged a conflict of interest, since Eze—whose account had also been compromised—had led the inquiry.

He demanded forensic logs, admin-assignment records, and a legal basis for withholding his pay. He also claimed misuse of police authority and personal endangerment. OurPass did not respond.

New year, new problems

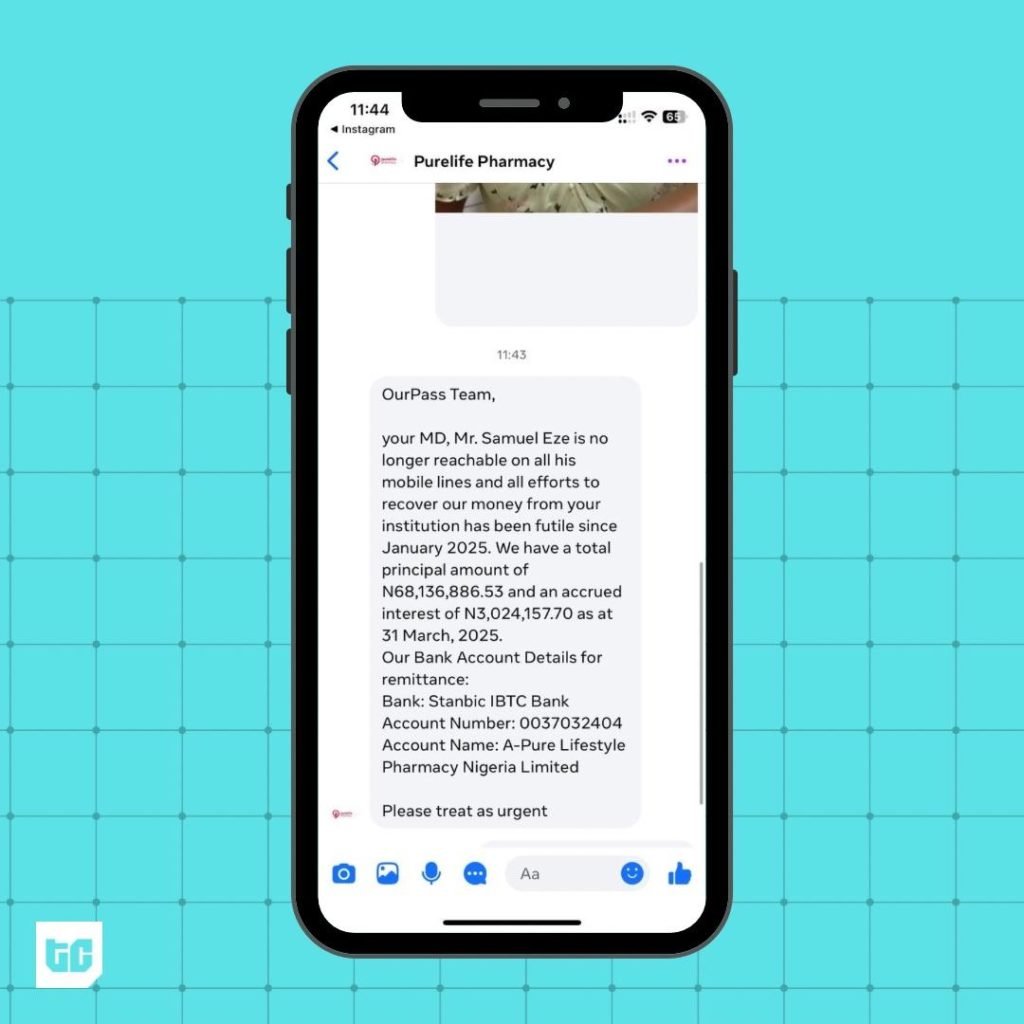

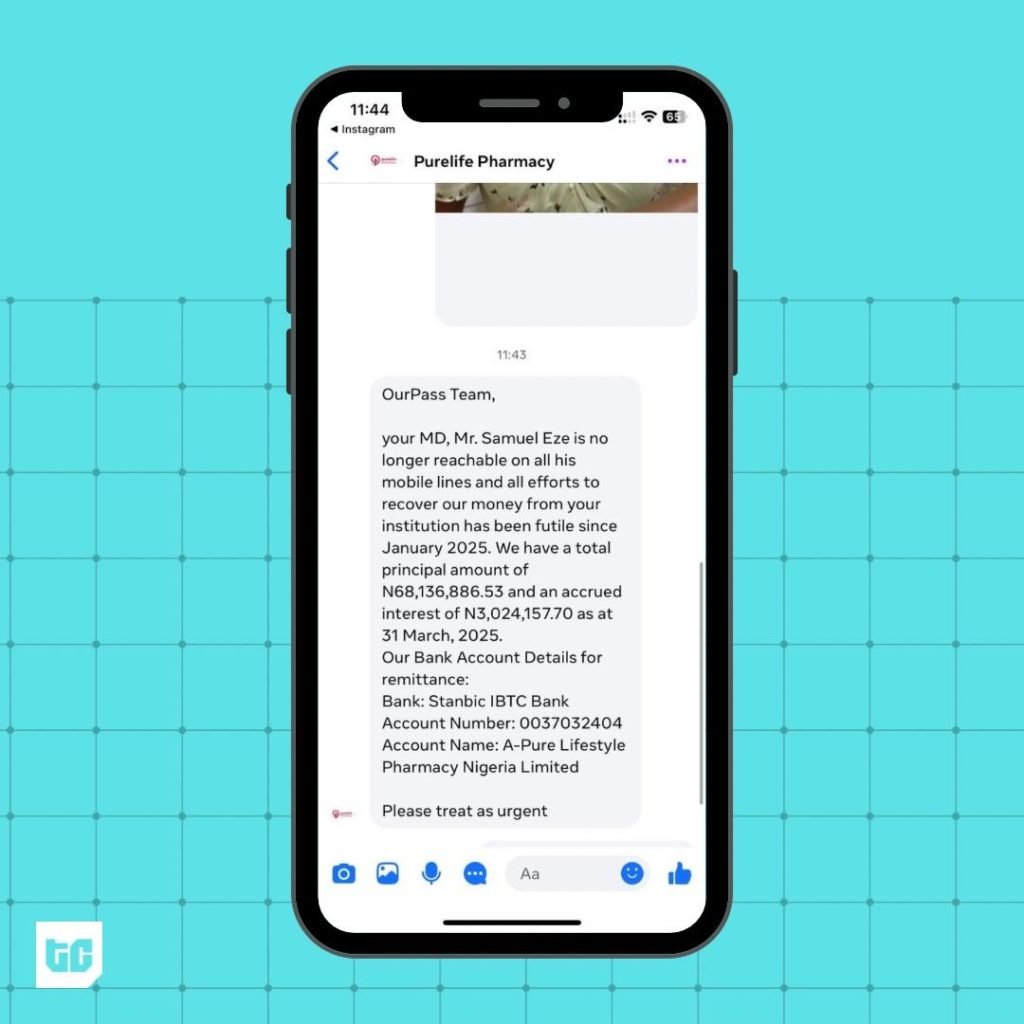

The June 2024 breach would not be the last sign of trouble at OurPass. By the end of the year, customers began reporting they could no longer access their deposits. In one case, a former marketing employee shared screenshots of OurPass’s Instagram direct messages filled with several complaints of customers being unable to withdraw their deposits.

In one case, PureLife, a Lagos-based pharmacy, is owed as much as ₦71 million ($46,200), according to screenshots seen by TechCabal.

In another exchange spanning from February to June 2025 between Eze and a customer, seen by TechCabal, the CEO repeatedly blamed “technical issues” for blocking the withdrawal of ₦23 million ($14,960) for over six months. The conversations show ₦2.3 million ($1,500) in failed transactions not reversed and ₦21 million ($13,600) trapped in the account.

Between February and April 2025, Eze repeatedly promised the customer that her complaints would be resolved within hours, days, or weeks. By June, the customer’s tone had shifted from pleading to confrontational after losing faith in Eze’s repeated promises, accusing the company of fraud, and threatening to report to legal authorities.

She still cannot access her deposits.

“This year, we went through a critical transition: migrating our core banking system to meet regulatory standards and strengthen infrastructure,” an OurPass spokesperson told TechCabal. “That migration is now almost complete, and the temporary liquidity challenges it caused are being actively managed with all concerned stakeholders.”

The migration and pivots

When OurPass launched in 2021 to simplify online shopping with one-click checkout, investors bought in. The company raised $1 million, with Tekedia Capital leading the round, soon after launch. By June 2022, after its original model proved unprofitable, OurPass pivoted to a “global bank for businesses,” offering smart banking, payment, and management tools to small- and medium-scale businesses (SMEs).

Yet, the pivots didn’t stop there. After acquiring a microfinance bank license in August 2024 and failing to gain traction from business banking, the startup pivoted again. This time, it announced it was attempting a move into personal banking, targeting everyday customers. There was only one problem. It would have to compete against deep-pocketed OPay, PalmPay, Moniepoint, Kuda, and Nigerian commercial banks after failing to establish itself as a business bank.

Former employees told TechCabal Eze blamed a core banking migration—resulting from the transition from business to personal banking—for significant financial losses and a cash crunch at the company. That cash crunch meant that OurPass could not honour customer withdrawals beyond small tickets of less than ₦200,000 ($130).

However, the drawn-out core banking migration, which is still unfinished, suggests OurPass’s problems run deeper than technology. Freezing customer accounts for months without a credible explanation points to solvency concerns and breaches both banking regulations and consumer protection laws. Under Nigerian banking law, deposit-taking institutions fall under the oversight of the Central Bank of Nigeria (CBN) and the Nigeria Deposit Insurance Corporation (NDIC), making prolonged account freezes a regulatory red flag.

The layoffs and resignations

Before the end of 2024, a round of layoffs left OurPass with few staff. With his startup on the brink of collapse, Eze began recruiting new employees himself on LinkedIn and lured them with offers of competitive salaries and the promise of building something new, according to former employees.

By January 2025, he had assembled a new team. However, when the new hires arrived at OurPass’ office in Victoria Island, Lagos, they were expecting to join a fintech company with a fresh vision. What they met, instead, were unclear roles and budgets held together with shoelaces. Three former employees who spoke to TechCabal on the condition of anonymity said they found a company with little structure and a CEO described by staff as having big ideas but struggling with execution.

The team’s first task was to revitalise the company’s image.

By March 2025, OurPass made a post on its Instagram account that read, “Hi guysss! We’re happy to announce that we are back and better!” The company’s last post before then was on August 21, 2024. Social media comment sections and customer support channels were filled with messages from businesses and individuals unable to withdraw their deposits.

Former employees say these complaints went unanswered for months before the March 2025 post.

Several employees said plans for events and campaigns were approved but not implemented. As the company worked to repair its public image, the team planned an app launch event and student ambassador programs, submitted budgets, and secured approvals, but the money never came.

“We drew plans for marketing campaigns for the launch of the personal banking app, but we never received approval for these funds,” one former employee told TechCabal.

Former employees also describe a cycle where OurPass hires teams, delays salaries, pushes grand plans, then watches staff drift away unpaid. “OurPass’ story is of a founder who repeatedly hired people, made them work, then owed them until they left,” said one former employee who spoke on the condition of anonymity.

As February 2025 ended, still owing salaries, the company told staff to open new OurPass accounts to receive their salaries, only to run into technical issues and further delays.

The company’s human resources officer repeated apologies weekly, blaming payment failures on the ongoing core banking migration. By March, the office closed, and employees were asked to work from home. Most had lost faith in the company’s ability to pay them at all. Many simply stopped showing up.

In a March meeting, CEO Eze told the heads of departments that the company had two options: shut down or have staff continue working without pay for three months while he tried to raise new funds. He offered a $10,000 bonus to department heads who stayed until the company stabilised. But for most, this was little comfort after months of unpaid wages.

Now, OurPass says it is putting its troubles behind it and has gone on a hiring spree in recent months. “We are strengthening our leadership team with experienced operators to guide OurPass into its next chapter,” a spokesperson told TechCabal.

Among the hires are a chief financial officer with more than 20 years in fintech finance operations, a chief operating officer with 25 years’ experience, a chief risk officer with two decades in fraud investigation and policy, and an engineering head with 15 years’ experience, the company’s spokesperson said.

“OurPass is now better positioned to do big things,” the company’s spokesperson said. “OurPass will become the infrastructure bank and credit backbone of Africa’s real economy, as it scales further within the FMCG value chain, by offering blockchain-powered lending, regulated digital banking, and real-time visibility from manufacturer to last-mile retail.”

However, as of August 2025, the company remains in limbo. Customers are still waiting for their deposits. Former staff are still waiting for salaries.

Mark your calendars! Moonshot by TechCabal is back in Lagos on October 15–16! Join Africa’s top founders, creatives & tech leaders for 2 days of keynotes, mixers & future-forward ideas. Early bird tickets now 20% off—don’t snooze! moonshot.techcabal.com

Leave a Reply