A Nigerian tier-2 commercial bank, with a market capitalization of ₦174.76 billion, has recently increased the salaries of its 3,000+ employees to help them deal with the rising costs of living and inflation. The adjustment, reportedly around 7%, was communicated through an internal memo in early January 2025.

This action reflects a broader trend in Nigerian banks, responding to economic pressures by reviewing compensation packages. In August 2024, the bank had introduced a cost-of-living adjustment (COLA) stipend, providing ₦75,000 to employees ranging from executive trainees to assistant banking officers. It is unclear if this stipend will continue in addition to the new salary structure.

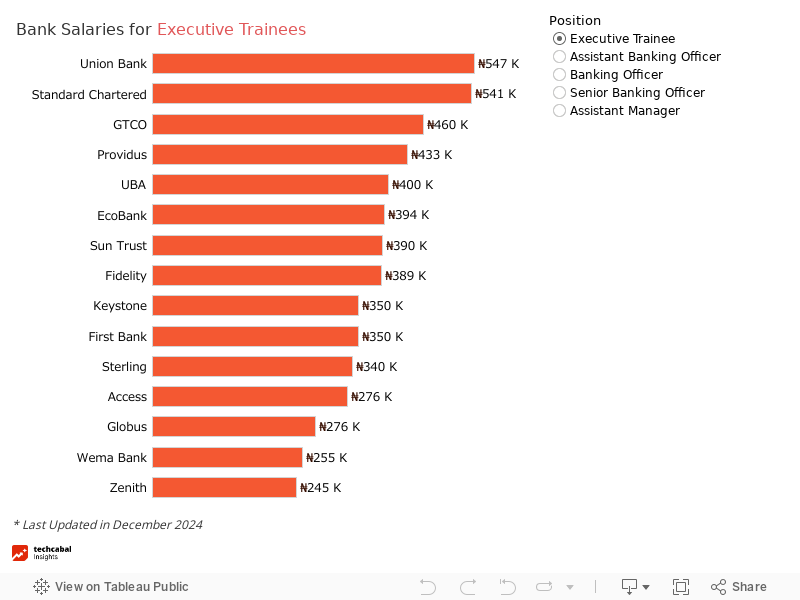

The specific salary figures have not been disclosed publicly; however, sources have confirmed that the adjustments are dependent on employees’ grade levels. The bank operates on a salary banding system, with increases typically falling within the 7% to 10% range. Many employees have been moved to the top of their bands due to recent adjustments. For example, executive trainees (ETs) who were earning ₦327,000 monthly will now receive ₦351,000, while senior executives on a ₦500,000 salary will see their pay increase to ₦527,000.

To manage these pay raises without promoting employees to higher ranks, the bank utilizes a tiered salary structure that includes internal “notches” within each grade level, allowing for raises without formal promotions, according to sources familiar with the bank’s compensation policies.

Despite the salary increment, some employees expressed disappointment, expecting larger raises similar to the 20-30% increases seen at other banks. “Considering inflation and the state of the economy, this feels underwhelming,” said one anonymous employee.

In late 2024, several other banks in the industry increased salaries by 40%, linked to concerns about talent retention amidst high employee turnover rates and frequent poaching. Competitive salaries have been shown to be crucial in reducing employee attrition in Nigeria’s banking sector.

The bank’s profit after tax for the period ending September 2024 was ₦27.4 billion, marking a 67.07% year-on-year increase. For the first quarter of 2025, the bank is projecting gross earnings of ₦121.8 billion.

As of September 2024, the bank’s personnel expenses reached ₦22.6 billion, a 38.65% increase from the previous year. If the new salary adjustments result in the typical 10% increase in expenses, the bank’s wage bill would be around ₦24.86 billion. Despite this, Sterling Bank’s wage bill remains lower compared to its competitors, with Union Bank reporting ₦34 billion, Fidelity Bank ₦43.6 billion, and FCMB ₦56.5 billion in personnel expenses.

Leave a Reply