In 2024, due to increased transaction charges and government scrutiny, more merchants in Kenya began shifting back to cash transactions. Cash now represents 80% of daily transactions in the country, according to Financial Sector Deepening Kenya.

Small shop operators expressed concerns to industry sources that they were opting for cash payments over mobile money to avoid potential tax implications from the Kenya Revenue Authority (KRA).

Will M-Pesa’s Dominance in Mobile Payments be Challenged?

There is speculation about whether M-Pesa’s dominance in Kenya’s payment landscape could be disrupted. However, data from the Communications Authority of Kenya (CA) and the Central Bank of Kenya (CBK) indicates that Safaricom’s hold on mobile payments remains strong despite efforts from competitors like Airtel Money, commercial banks, and payment startups.

Competitors are investing heavily in infrastructure, marketing, and new products to compete with M-Pesa. Pesalink, allowing real-time transfers to commercial banks, and Airtel Money, with improved mobile money interoperability, are emerging as significant challengers to M-Pesa’s market dominance.

Airtel Money’s market share grew from 2.8% to 6.6% within a year, showcasing a shift in the mobile payments landscape, although M-Pesa still commands a significant 93.4% market share.

Mobile Money Landscape

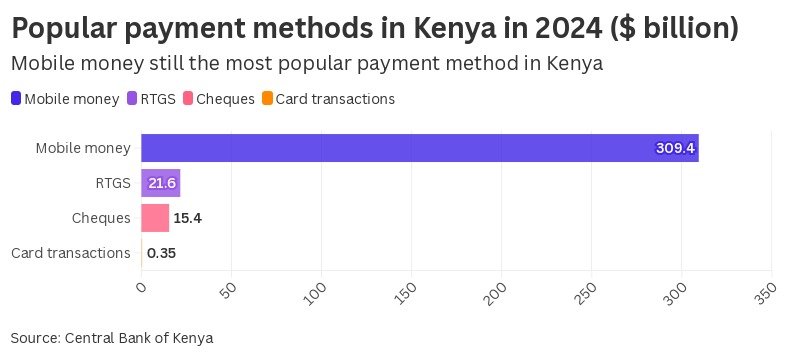

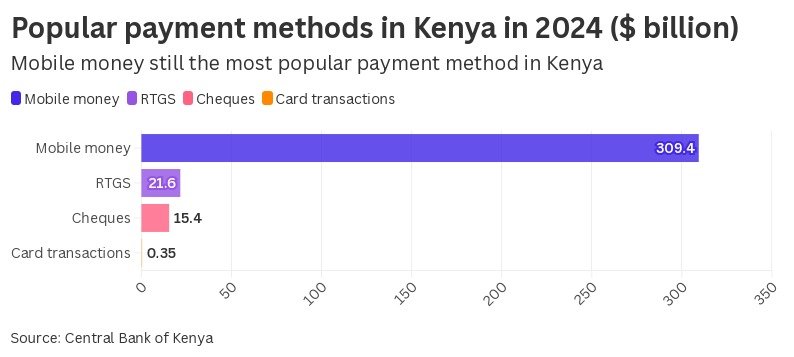

Between January and October 2024, Safaricom and Airtel processed over 25 billion transactions valued at over $309.4 billion (KES40 trillion). M-Pesa and Airtel Money continue to be popular payment platforms, particularly among Kenya’s unbanked population, facilitating cash transfers in rural areas and serving as a vital tool for small businesses.

Neighborhood shops and small businesses increasingly rely on these platforms for transactions, including supplier payments and utility bill settlements. The daily transaction limits make M-Pesa and Airtel Money suitable for medium to small transactions.

Cheques and RTGS

Even though mobile money dominates, traditional methods such as cheques and the Real-Time Gross Payment System (RTGS) remain crucial for larger transactions. Cheques worth $15.4 billion (KES2 trillion) and RTGS transactions totaling $21.6 billion (KES2.8 trillion) were cleared between January and October 2024.

However, cheque usage is declining, with a 15.1% drop in value observed in June 2024, similar to the decrease during the Covid-19 period when businesses were affected by protests.

Card Transactions in a Mobile-Centric Economy

Card payment growth in Kenya has been slow compared to mobile money transactions. Total card transactions, including POS payments and ATM withdrawals, amounted to $355.8 million (KES 46 billion) in the ten months leading to October 2024, reflecting the country’s strong preference for mobile wallets. Debit cards are more popular than credit cards, with credit card penetration at 5.6%.

Leave a Reply