In the period between 2016 and 2019, the emergence of fintech companies like Paystack and Flutterwave posed a challenge to traditional banks in Nigeria, pushing them to innovate or risk being left behind. One such bank, GTCO, responded by launching Habari, a super-app in 2018 that integrated digital banking with various lifestyle services. However, the platform struggled to stand out, lacking a unique feature to attract and retain users.

Subsequently, in 2022, GTCO shifted its focus to the fintech sector by establishing HabariPay Limited, a subsidiary offering payment and digital financial services. Despite facing stiff competition from established players like Paystack and Flutterwave, as well as digital banks such as Moniepoint and OPay, HabariPay Limited managed to contribute significantly to GTCO’s profits.

Although HabariPay’s overall contribution to GTCO’s profits remains modest, the company has been working on expanding its services to solidify its position within the portfolio. The CEO, Eduofon Japhet, highlighted the company’s efforts to enhance POS terminal services for merchants and streamline mobile transfers to compete effectively in the market.

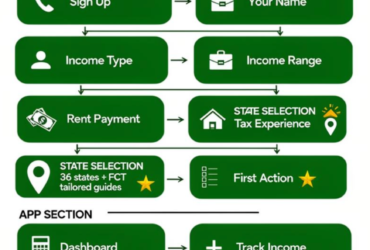

Eduofon Japhet discussed HabariPay’s journey and strategies during an event in Abeokuta, emphasizing the importance of finding value-driven solutions in a competitive market. HabariPay differentiated itself by focusing on building local infrastructure to support micro-payments, offering NFC-based POS solutions, and developing a switch to process transactions efficiently.

When addressing financial inclusion for the unbanked population, HabariPay acquired necessary licenses to build essential payment infrastructure and connect with various banks and fintech companies. By enabling affordable and accessible digital payment solutions, the company aims to contribute to economic inclusion and support initiatives that create value for all participants.

Looking ahead, HabariPay expects growth across various indices and has obtained licenses to expand its payment services, including powering POS terminals and enhancing transfer payments to match the convenience of card transactions. The company’s goal is to make transfer payments more accessible and sophisticated, ultimately replacing traditional agents with digital solutions.

Leave a Reply