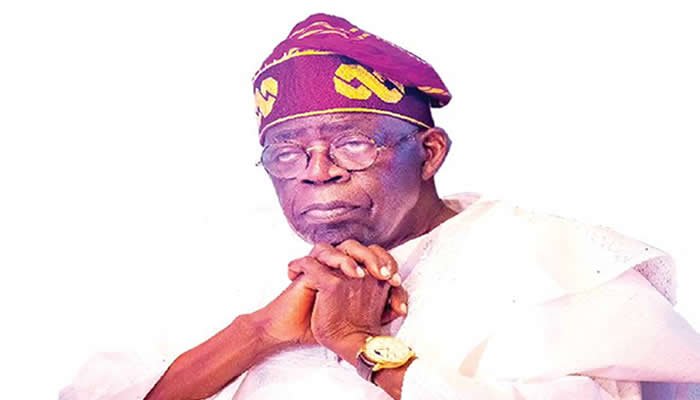

President Bola Tinubu recently addressed the issue of withdrawing a tax reforms bill from the National Assembly. He emphasized the possibility of making necessary changes to the bill during the legislative process without the need for withdrawal. Tinubu’s stance was conveyed through his Special Adviser on Information and Strategy, Mr. Bayo Onanuga, in a statement titled ‘Proposed tax reforms bills should go through the legislative process; inputs can be made at public hearings.’

The National Economic Council had recommended withdrawing the bill for further consultation, but Tinubu expressed appreciation for the advice while emphasizing the ongoing legislative process’s flexibility for modifications. He welcomed additional consultations to address concerns before the National Assembly’s consideration.

This development followed the council’s request, led by Vice President Kashim Shettima, urging withdrawal of the tax reforms bill for broader consultations due to discomfort with certain sections. The aim is to build consensus and understanding among stakeholders.

The tax reforms proposed by President Bola Tinubu and the Federal Executive Council aim to streamline tax processes, establish a unified revenue service, and simplify financial obligations for businesses and citizens. These reforms are based on recommendations from a committee led by Taiwo Oyedele and consist of four executive bills focusing on tax elimination, administrative efficiency, revenue service establishment, and a Joint Revenue Board.

Despite some resistance from governors of 19 northern states regarding Value-Added Tax distribution, the Presidency contends that the tax reform bills will benefit all states by harmonizing tax laws for improved efficiency. The objective is to coordinate federal, state, and local tax authorities to eliminate past inefficiencies and confusion in Nigeria’s tax administration system.

Leave a Reply