The National Pension Commission has revealed that the total pension fund assets managed under the Contributory Pension Scheme have reached N21.92tn as of October 2024, with contributions coming from 10.53 million registered participants. The commission expects this figure to surpass N22tn by the end of the year.

During the 2024 PenCom Media Conference in Abuja, the Director-General of PenCom, Ms Omolola Oloworaran, emphasized the Commission’s dedication to safeguarding contributors’ funds through careful management and sustainable growth strategies. She highlighted the economic challenges affecting the pension fund, such as high inflation, naira devaluation, and the impact of unorthodox monetary policies on the real value of pension funds and contributors’ purchasing power.

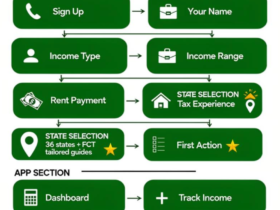

To address these challenges, PenCom is reviewing Investment Regulations to diversify pension fund investments into inflation-protected instruments, alternative assets, and foreign-currency denominated investments. The Commission is also focusing on expanding pension coverage, including revamping the Micro Pension Plan and leveraging technology to encourage participation from the informal sector.

Furthermore, efforts are being made to expedite the payment of retirement benefits to retirees of Federal Government treasury-funded Ministries, Departments, and Agencies. Oloworaran mentioned that N44bn has been allocated to settle accrued pension rights for retirees from March to September 2023, with ongoing collaboration with the Federal Government to ensure timely benefit disbursement.

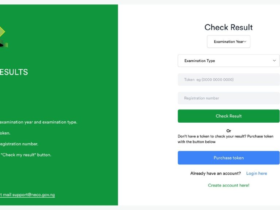

Additionally, PenCom introduced an e-application portal for Pension Clearance Certificates to streamline the application process for companies. The Pension Industry Shared Service Initiative is also being implemented to digitize pension contributions and remittances, aiming to enhance efficiency and resolve discrepancies.

Moreover, the commission has updated the programmed withdrawal template to simplify access to voluntary contributions and adjust en-bloc payment thresholds in alignment with the new minimum wage. Looking forward, PenCom plans to integrate technology comprehensively into the pension industry in 2025 to improve accessibility, reliability, and sustainability within the system. Oloworaran urged the media to support PenCom by raising public awareness about the Contributory Pension Scheme.

Leave a Reply